Product Overview

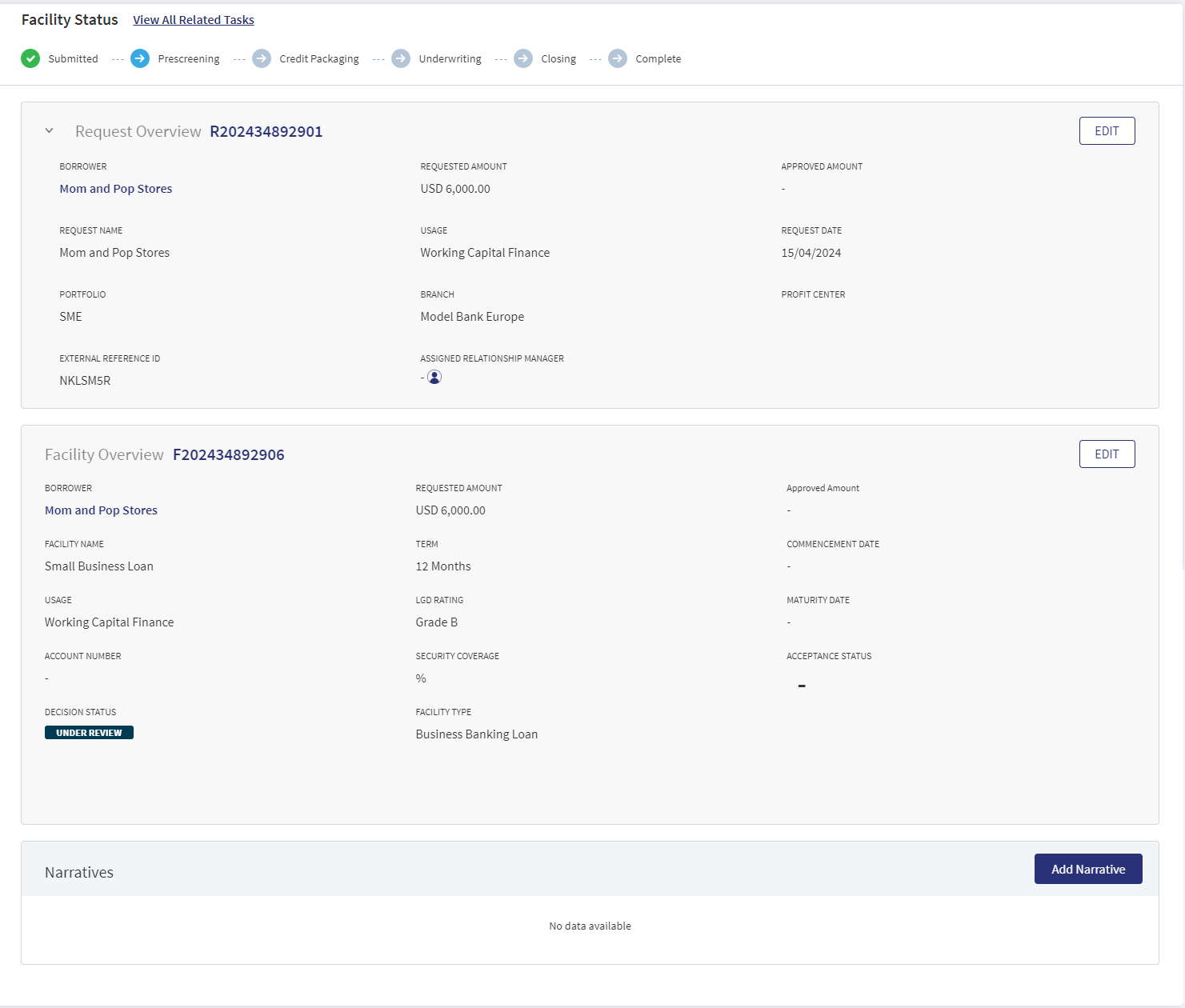

Use the functionality to view the details of a Facility/Product associated with a request. The feature is applicable to all bank users who are assigned the required permissions to manage requests. There can be multiple facilities/Products in a request.

To open the Facility/Product overview screen, navigate to the Request Overview screen and click the Facility ID/Product ID link.

Throughout the document, the following terms are used interchangeably: Facility and Product. The Term Product is applicable for Retail Journey.

The application displays the Facility/Product Overview screen with the following details:

Left pane menu

- The menu items on the left pane and the corresponding details on the right pane. Click any menu item on the left pane to view the corresponding details on the right pane.

Stage Indicator

- The current stage of the facility is displayed on the stage indicator on top of the screen.

- The facility wise stages starts post Underwriting. The current nine stages will be available at a facility overview level. This is applicable only for corporate lending requests. Also see Retail lending, SME lending, and Corporate lending journeys for more information.

- If the Request has been withdrawn by the user, the stage is updated as Withdrawn.

- The stage synchronizes everywhere in the solution such as the RM and Supervisor dashboards, on the stage indicator of the request overview screen, and task status.

- A bank user can see the current stage of the request with status and view the tasks by clicking the View All Related Tasks link with the count of pending and completed tasks related to the facility in parenthesis. The number of tasks is the sum of all pending + completed tasks from prescreening to the stage until which the tasks are generated for the selected facility.

- After all the task statuses under a stage are either waived or complete, the current stage is marked as completed and the request moves on to the next stage.

The stage is yet to be visited.

The stage is yet to be visited. The tasks are in progress and one or more tasks are to be completed. The application is still in the stage.

The tasks are in progress and one or more tasks are to be completed. The application is still in the stage.  All tasks in the stage have been completed. The request is moved out of the stage.

All tasks in the stage have been completed. The request is moved out of the stage.

Task sticky footer

The task sticky footer is displayed on the bottom of the screen. Applicable only if navigated to this screen from the tasks list screen.

Stick header

When the user scroll down the overview screen, the following facility overview fields are frozen on top of the screen: Borrower name, Amount, and Facility Type.

General

The application displays the following menu items under the General menu on the left pane. By default, the facility overview details are displayed on the right pane.

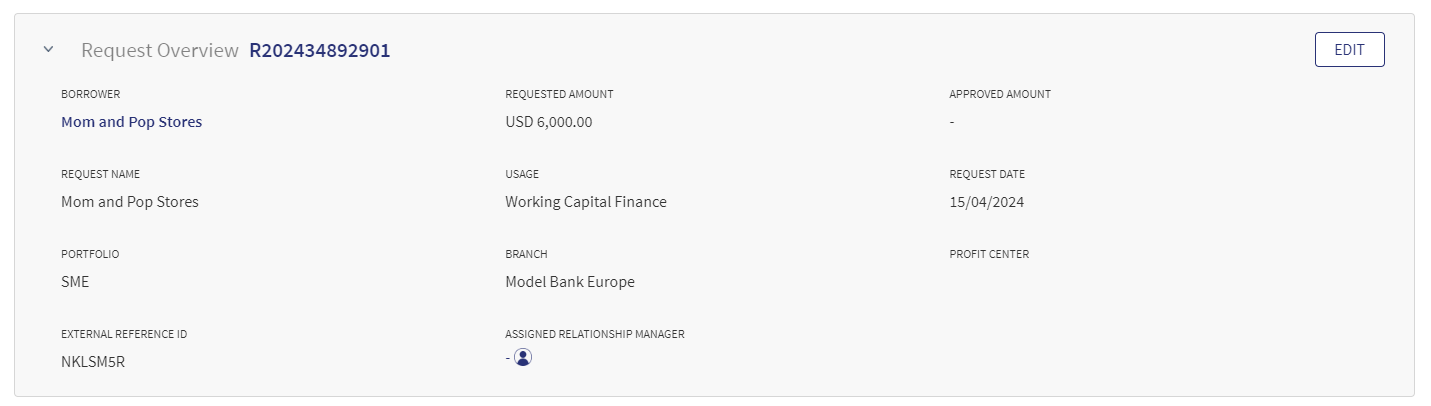

Request Overview

Click the down arrow to view the request overview details. The application displays the information that were collected during the on-boarding process (create request) and few information from the back-end system, for instance, the bank branch, portfolio, and profit center are mapped with the signed-in (relationship manager).

The following details display in the Request Overview:

- Borrower

- Requested Amount

- Assigned Relationship Manager (RM)

- Request Name

- Usage or the purpose of the request

- Request Date

- Portfolio

- Branch

- Profit Center

- External Reference ID

- Approved Amount

Do any of the following:

- Click the Request ID to view the request overview details.

- Click the Borrower link who is the primary borrower of the request to view the entity overview details.

- Click Edit to modify the request details.

- Click the icon to view the relationship manager contact card - email, address, phone, and bank branch.

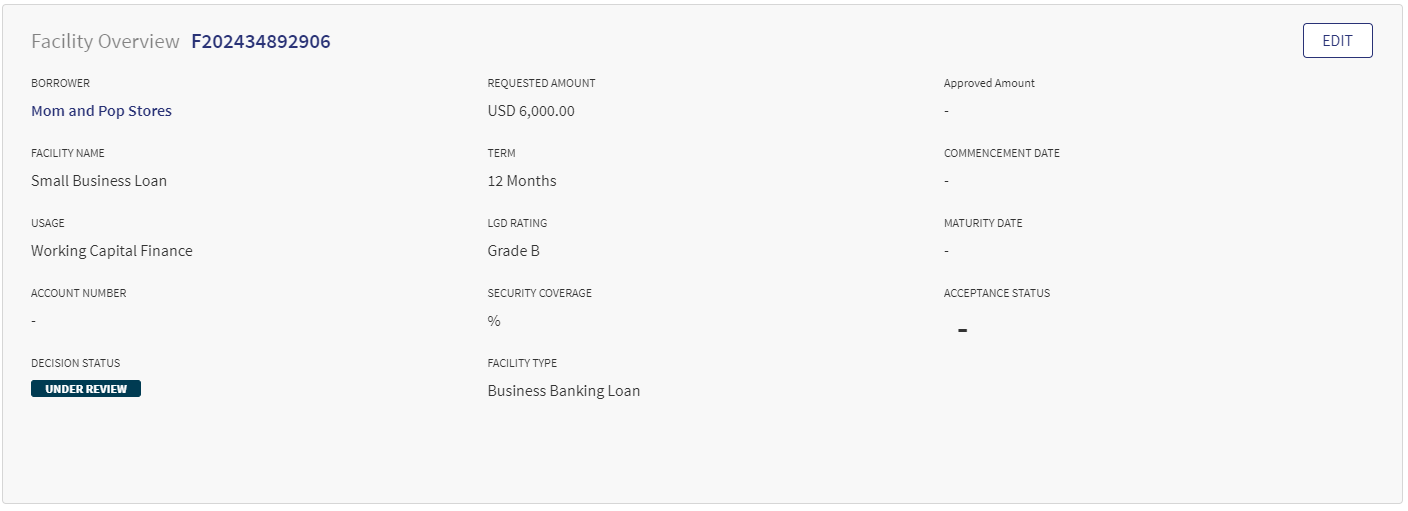

Facility Overview/Product Overview

The application displays the information that were collected during the on-boarding process (create request).

The Retail user ( Retail RM, Mortgage RM , Retail Ops or any Retail Specific) logged into the Temenos Digital Assist Facility Overview views the Facility Overview as Product Overview. The breadcrumbs of the ID have the following Prefix:

- Request ID: Request Number

- Product ID: Product Number

- Drawing ID: Drawing Number

- Entity Name: Actual Entity Name

The above breadcrumbs are applicable for all the Overview- Request, Product , Drawing and Entity overview (applicable only for Retail).

The following details display in the Product Overview:

- Borrower name

- Amount

- Facility Type

- Usage

- Facility Name

- Term

- Commencement Date

- Maturity Date

- Decision Status

- Approved Amount

- Acceptance Status

- Account Number

- Cumulative DTI

Borrower name, Amount, Facility Type, Usage, Facility Name, Term, Commencement Date, Usage, LGD Rating (loss given default), Maturity Date (automatically calculated based on commencement date and term), Account Number (updated with account number which is received from the core/backend on creation of account. Until the field is updated at the fulfillment, this field displays a hyphen), Security Coverage percentage, Acceptance Status, and Decision Status ,Cumulative DTI Ratio(Retail Facility Overview). Any field which does not have a value or is blank, displays a hyphen.

- Borrower or the main applicant's name.

- Requested Amount with Currency: Displays the total of all facilities (New and Modified Facility) that are applied in the application such as the sum of all the requested facilities. The Requested Amount for Modification is also displayed.

- Facility Type: This is displayed based on the category in Marketing Catalog microservice.

- Facility Name

- Term: For personal and business loans as captured at product level in the Origination app and for overdraft as set up in Marketing Catalog microservice.

- Commencement Date

- Usage displays the purpose as captured during request creation.

- LGD Rating (loss given default)

- Maturity Date: Automatically calculated based on commencement date and term.

- Account Number: Updated with account number which is received from the core/backend on creation of account. Until the field is updated at the fulfillment, this field will be blank.

- Security Coverage in percentage.

- Acceptance Status: The Relationship Manager(RM) updates in the Underwriting stage as Accepted or Rejected, this status icon is only applicable for new facilities. If you hover over the icon - Offer Accepted (or) Offer Rejected information is displayed.

- Decision Status: This field is not applicable for Retail lending and SME lending requests.

- History: This option displays all the previous information.

- Additional Information: This section is displayed only if the Facility Type is Letter of Credit or Letter of Guarantee. On expanding the section, the application displays Beneficiary field where the user can enter the beneficiary details (optional) manually by clicking the Edit button, and an information icon when hovered, displays the message, "Commission can be added in Borrower Fee section".

After the origination of an overdraft and loan accounts, the relevant details of the product are displayed on the request overview screen and the account number is displayed on the facility overview screen after receiving from the core/backend on creation of the account.

Click the Borrower link who is the primary borrower of the facility to view the entity overview details.

You can view all the modification facilities along with the new facilities in the facilities section with the following fields : Facility ID, Facility type, Amount, term, Decision Status.

Edit: Click Edit to modify the facility details.

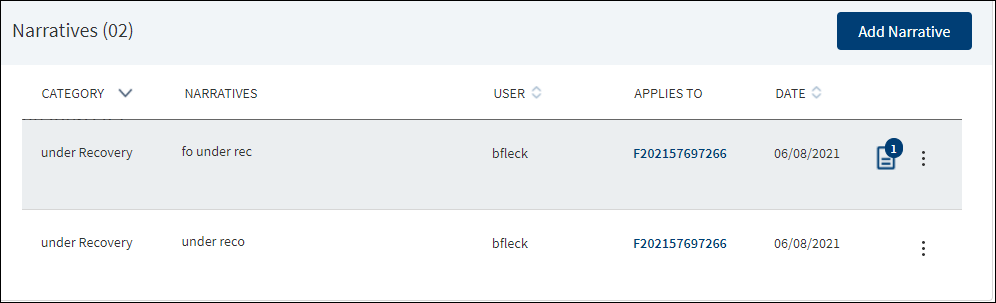

Narratives

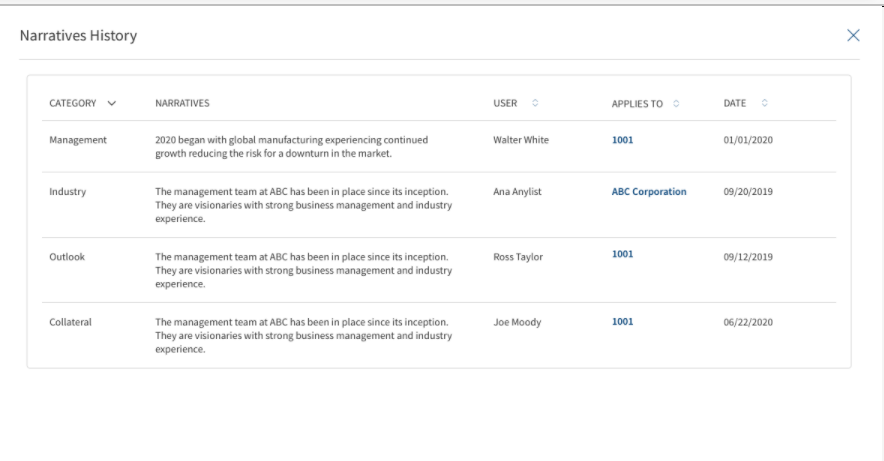

The application displays the list of narrative or comments entered for a facility/product with the following details: Category, Narratives, User name, Applies To facility or entity, and Date of narration. The ![]() icon denotes that the narrative has document attachments. Click the icon to view the narrative details.

icon denotes that the narrative has document attachments. Click the icon to view the narrative details.

The History button on the screen displays the Narratives from the previous Facility/Product. It provides the following details:

- Category

- Narratives

- User

- Applies To

- Date

New facilities that are linked to the same request will not appear for selection. When the narratives are added in the request overview, it displays in both the request overview and the facility overview.

Do any of the following

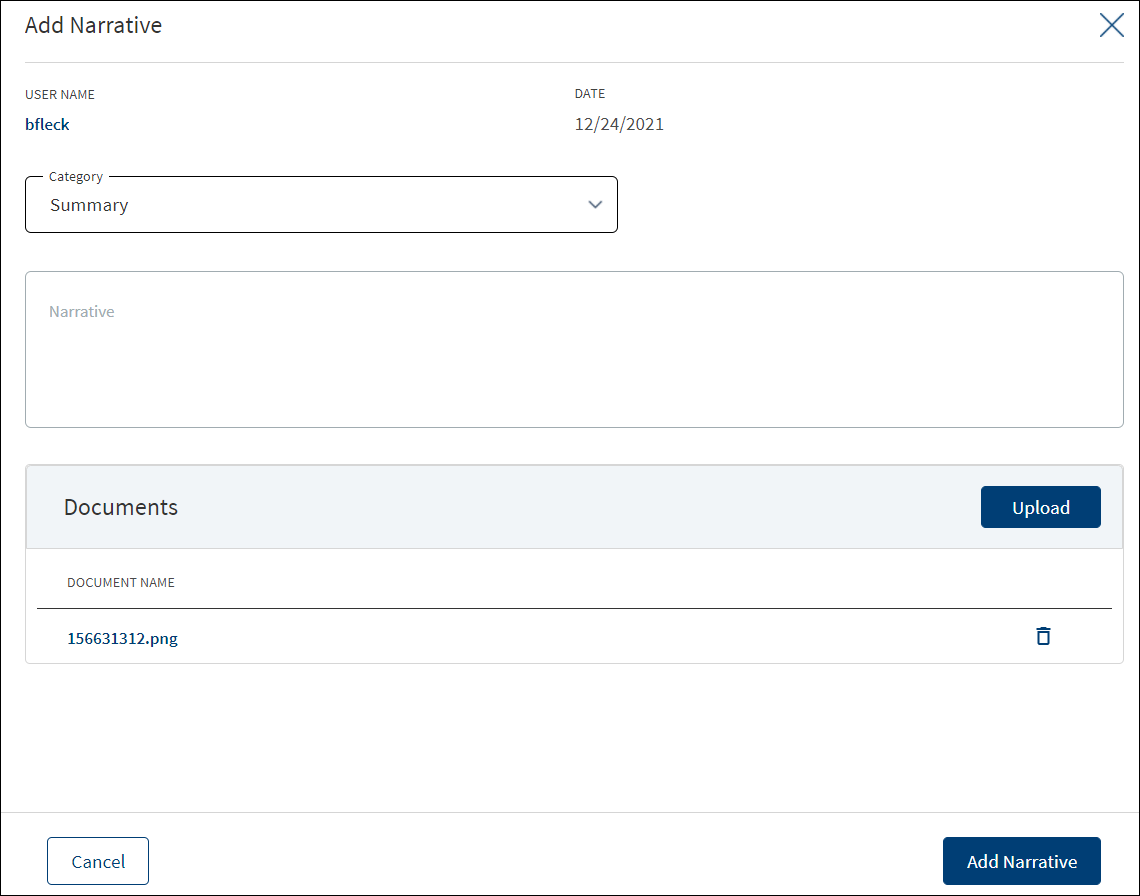

- Click Add Narrative.

- Use the context menu as required.

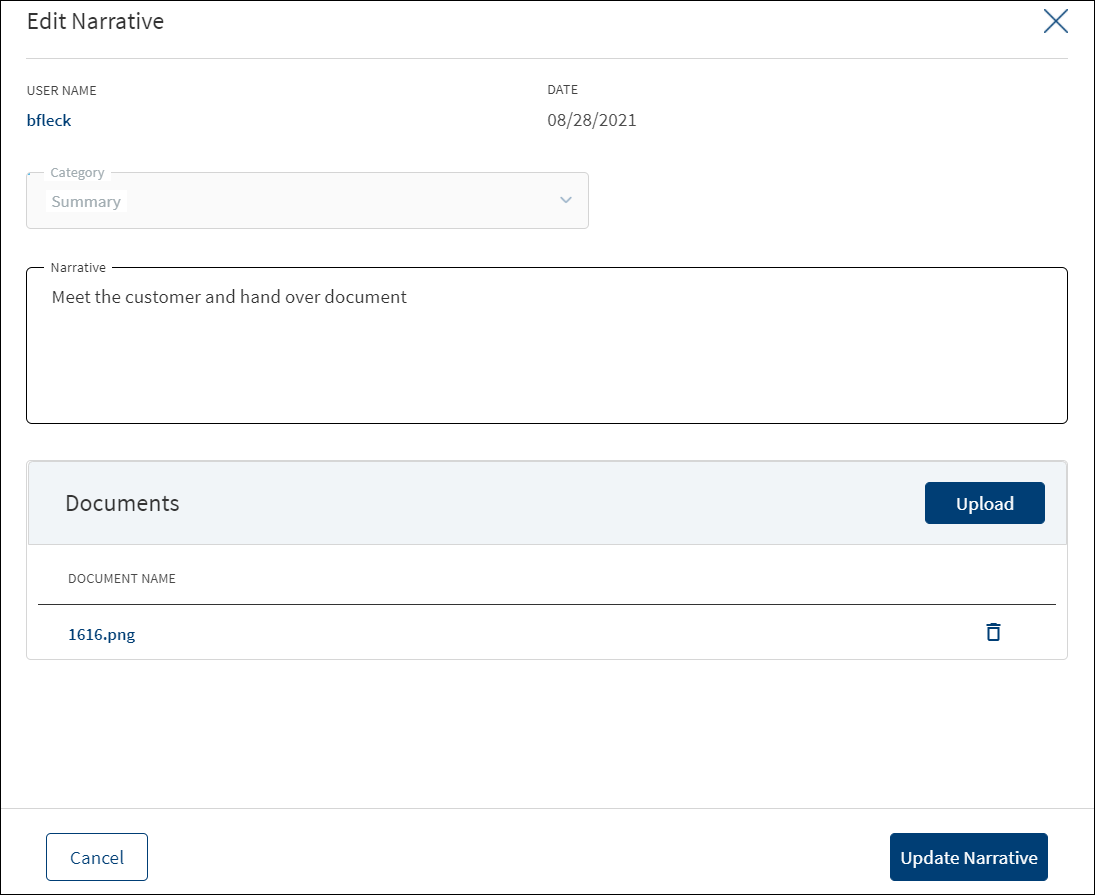

- Click Edit to modify the details.

- Click Delete to remove the record. In the confirmation pop-up that appears, click Yes. The record is removed. On deleting the narrative, the attached documents are also deleted.

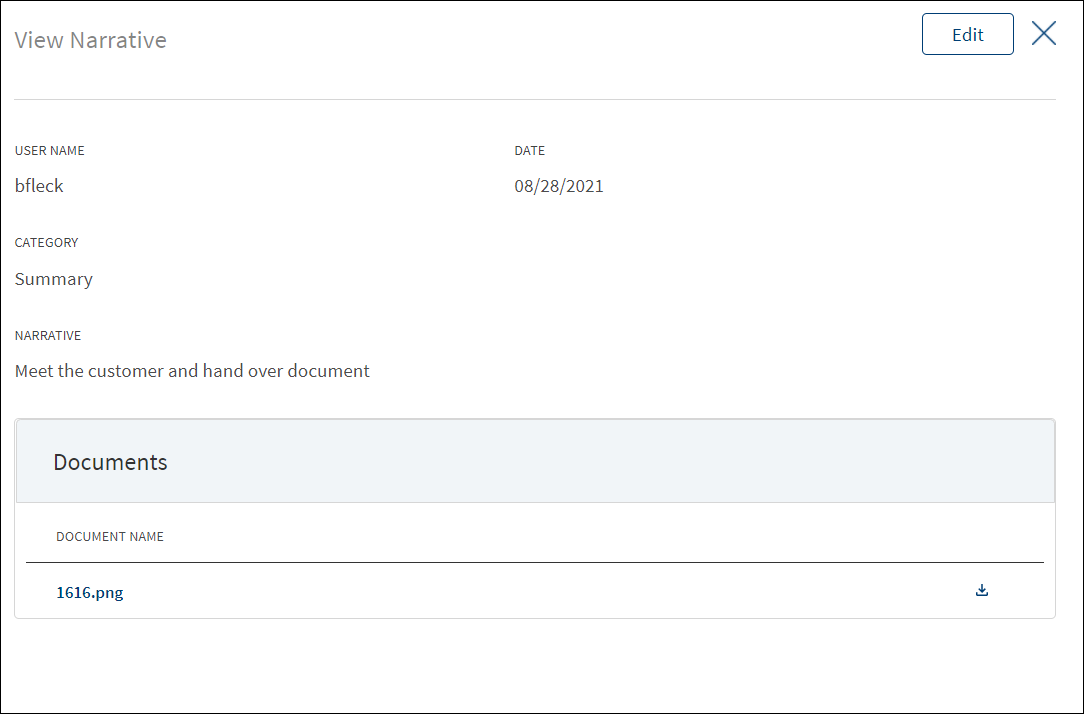

- View details: Click any row to view the narrative details.

- Click Edit to modify the details or click X to close the form.

- Click the Document Name to view and download the document.

- Click Add Narrative to add a narrative.

- The application displays the signed-in user's user name and date of narration.

- Select the Category from the list (for example, Summary, Financial, Pricing).

- Enter Narrative description. It is a mandatory field. When a lengthy comment or description is entered which does not fit the field, then the content moves to the next line of the field. The field accepts up to 1000 characters.

- The application displays the list of parties, facilities, or collateral depending on the selected Category. For example, on selecting Under Recovery, the application displays the facilities to map the narrative. On selecting, Financial or Guarantor, the application displays the parties to which the narrative can be mapped. It is mandatory to select at least one item from the list. Selection can be one, many, or all the items.

- The application displays the list of parties or collateral under the section depending on the selected Category. It is mandatory to select at least one item from the list. Selection can be one, many, or all the items. By default, no item is selected. The following is the narrative mapping to the selected category:

- Party: On selecting Financial, Guarantor, Historical, Industry, Risks & Mitigation, Sources & Uses of Funds, or Management, the application displays the parties to which the narrative can be mapped. This is a multi-select option and can user select multiple parties to this narrative. By default, no party is selected. The party related narratives are displayed on facility overview.

- Facility: On selecting Pricing or Payment History, the apply this narrative section does not appear. The facility related narratives are displayed on request overview and facility overview.

- General: On selecting Summary, apply this narrative section does not appear. The added narratives are displayed on the respective overview screens. For example, a summary narrative added on the request overview is displayed only on the request overview screen.

- Click Upload Document to upload files to a narrative. A confirmation pop-up appears with maximum size and file name conditions. Click Okay to browse and upload the file. The uploaded document appears. This field is optional.

- Click the bin icon displayed beside each uploaded file to delete the file before adding a narrative.

- The document name can be alphanumeric and cannot contain spaces, and the maximum file size can be up to 25 MB.

- The following document types can be uploaded: jpeg, pdf, jpg, png, txt.

- Click Add Narrative. The application displays a confirmation message that the narrative is added successfully and adds the record to the Narratives list.

- Make the changes as required.

- A user who added the narrative can modify the following details. Other user can only view the details.

- Narrative text and Applies to in case of entity related narrative.

- Narrative text in case of facility related narrative.

- Click Download to download the existing files. If there are no existing files, click Upload to upload new files. On clicking Update, the uploaded files are successfully saved and updated in the summary screen. Upload the documents at once before updating the narrative.

- Click Update Narrative to save the details.

- The application displays a confirmation message that the narrative is updated successfully.

Click Cancel to discard the changes. On the confirmation pop-up that appears, click Yes. The changes are not saved.

Documents

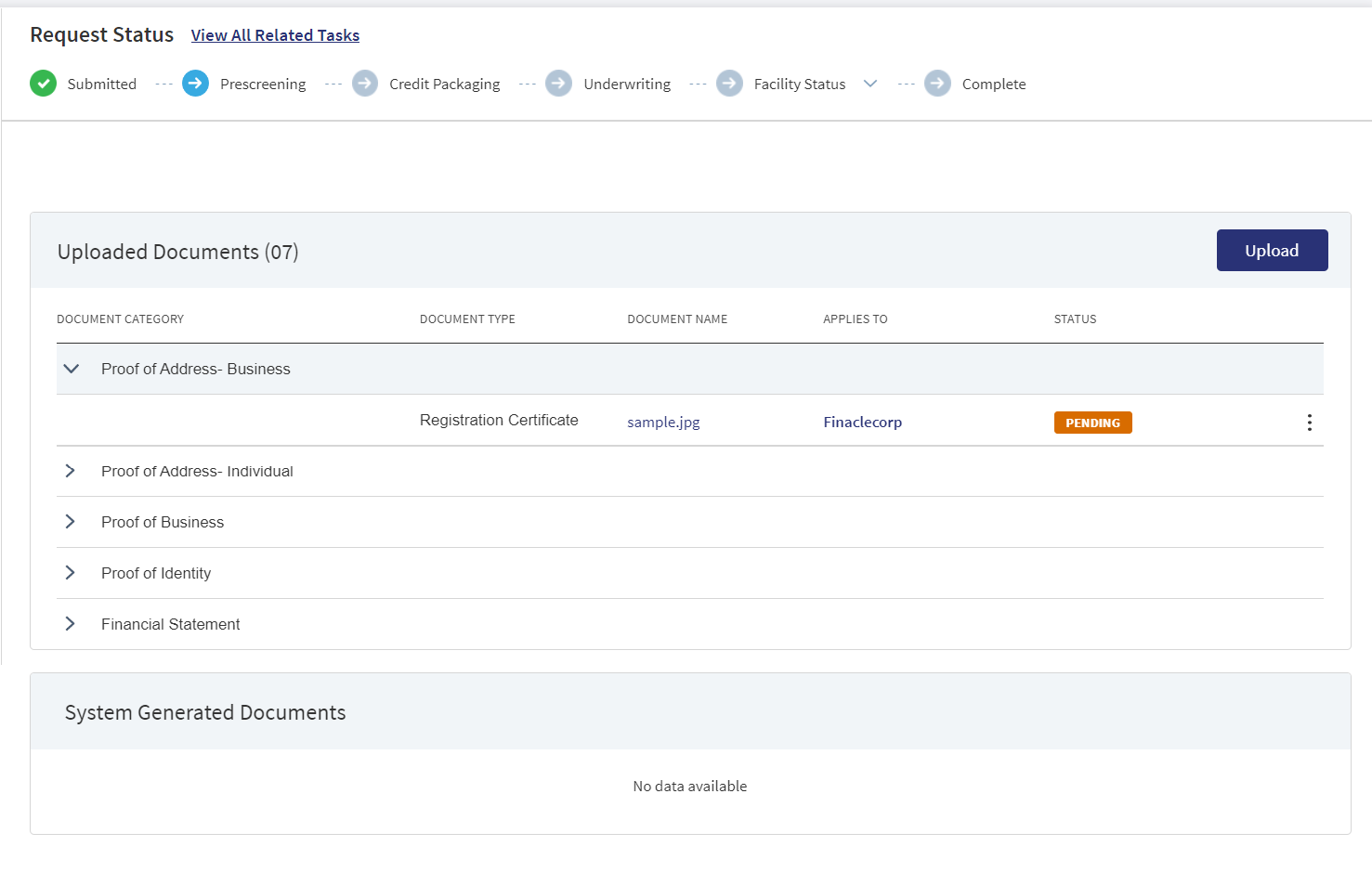

The application displays the list of documents associated with an entity, facility, or a collateral. All documents uploaded in front-end Origination as part of the overdraft or loan lending are visible in the documents list. The Documents can be added to both new and modification facility in the Request Overview Documents section. The documents can be of evidence and financial proof of identity and address, balance sheet, cash flow statement among others. The Documents displayed are collected from the Evidence Management and as per the DMN rules displayed in the Request Overview. Document Microservice stores the document reference and the actual file stores in downstream DMS,Which by default is Formpipe Product.

This section consists of two sub-sections:

- Uploaded Documents - Documents uploaded by Customer/bank user.

- System Generated Documents - The documents generated by system.

Uploaded Documents: This section displays the documents uploaded by the customer from the Origination app and by the Bank user. They are displayed by Document category group and this category has an accordion view, which on expanding displays the actual document along with the document type.

This section consists of the following fields:

- Document Category - Displays the document category - Facility, Entity, Request, or Collateral.

- Document Type - Documents submitted before submission in the Origination app have the type as stored in Document MS.

- Document Name - The documents submitted before submission in the Origination app have the name File Information as given by the customer. If there is no File Information added, then the document name is added as file name.

- Applies To - Request, Facility, Party, or Collateral.

- Status - Displays the status of the document in different color depending on the status - Approved, Pending, Signed, Delivered, Reviewed or Rejected. All documents uploaded in the Origination app will be in Pending status.

View Checklist :A checklist is a group of associated documents. It displays all the required document with the status if they are pending for upload/uploaded/approved/reviewed. The Checklist option displays only in the Facility Overview and when clicked on it, Facility wise document checklist displays in a pop-up window. The Checklist is dynamic and displays based on the DMN Rules. If the Customer Action documents are part of Checklist , the checklist status gets updated based on the document status.

If a particular document is uploaded (based on DMN rule) in the checklist, it displays with following color code:

- Orange - if the status is Pending or Signed.

- Green - if the status is Approved, Reviewed or Delivered.

- Red - if the status is Rejected or Failed.

The Documents in the checklist are displayed as:

- Document Category.

- Document Types within the category.

- Applies to Entity , Collateral or Facility.

A Checklist icon displays beside each Document Category for both Uploaded Document and System Generated Document section. When hovered over it, the uploaded document within the required Document category display, incase the documents are yet to be uploaded it shows as no required documents.

The accordion view also displays the same details as the Checklist Icon.

In the Document section of the Facility Overview, if a particular document is uploaded in the checklist and checklist icon within the Document type, a Tick mark displays. If the checklist/checklist icon for the document type is complete, the Tick mark appears Green in Color. This is applicable for both Uploaded Document and System Generated Document. In case there are multiple documents uploaded for the same Document Type, then until the status of all the documents are Approved/Reviewed/Delivered the status for the Document type does not get complete (Green).

Uploaded Documents - Approved/Reviewed

System Generated Document(this is applicable only to Checklist Icon) - DeliveredUpload : To upload a new document.

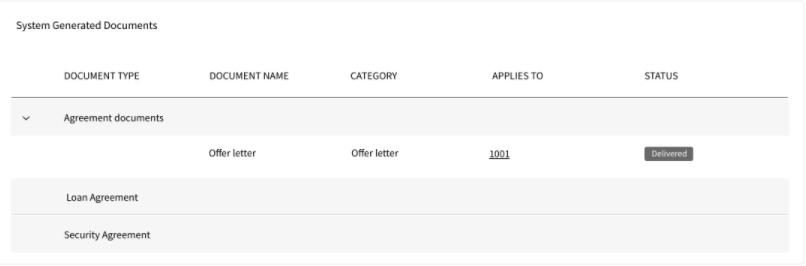

System Generated Documents :This section displays the documents generated by the system in Temenos Digital Assist. They are displayed by Document category group and this category has an accordion view, which on expanding displays the actual document along with the document type.

This section consists of the following fields:

- Document Type - Documents submitted before submission in the Origination app have the type as stored in Document MS.

- Document Name - The documents submitted before submission in the Origination app have the name File Information as given by the customer. If there is no File Information added, then the document name is added as file name.

- Document Category - Displays the document category

- Applies To - Request, Facility, Party, or Collateral.

- Status - Displays the status of the document in different color depending on the status - Approved, Pending, Signed, Delivered, Reviewed or Rejected. All documents uploaded in the Origination app will be in Pending status.

Mapping between the Origination document type with Temenos Digital Assist document type.

| Document Type in Temenos Digital Origination | Document Type in Temenos Digital Assist |

|---|---|

| Entity Certification/Registration | EntityCertification |

| Tax ID Number Certification | TaxIdCertification |

| Articles of Incorporation | Article of Incorporation |

| Partnership Agreement / Declaration | PartnershipAgreement |

| Trust Agreement / Declaration | TrustAgreement |

| Article of Incorporation | ArticlesIncorporation |

| Financial Statement | FinancialStatements |

| Passport | Passport |

| Driving License | DriverLicense |

| National ID | TaxIdCertification |

Perform any of the following:

- Download Document: Click the Document Name to view and download the document if required. To download, click Download on the screen the appears.

- View Details: Click the row to view the document details. Click the ID to view the overview details. The document can be mapped to a request, entity, facility, or a collateral.

- If the document category is applied to a collateral record, then the document is displayed in the document summary under the respective facilities where the collateral is used.

- If the document category is applied to entity record, then the document is displayed in the document summary under respective entity overview only and will not be available under request overview and facility overview.

- Click Upload to upload a new document.

- You will be able to view all the modification facilities listed along with the new facilities in facilities section with the following Facility ID, Facility type, Amount, term, Decision Status

- If both the Purpose options are selected initially, both New and Modification facilities are listed on this screen. Otherwise, only one of the Facility displays based on the selected purpose.

- Use the context menu as required. The context menu is displayed only for the documents with Pending status:

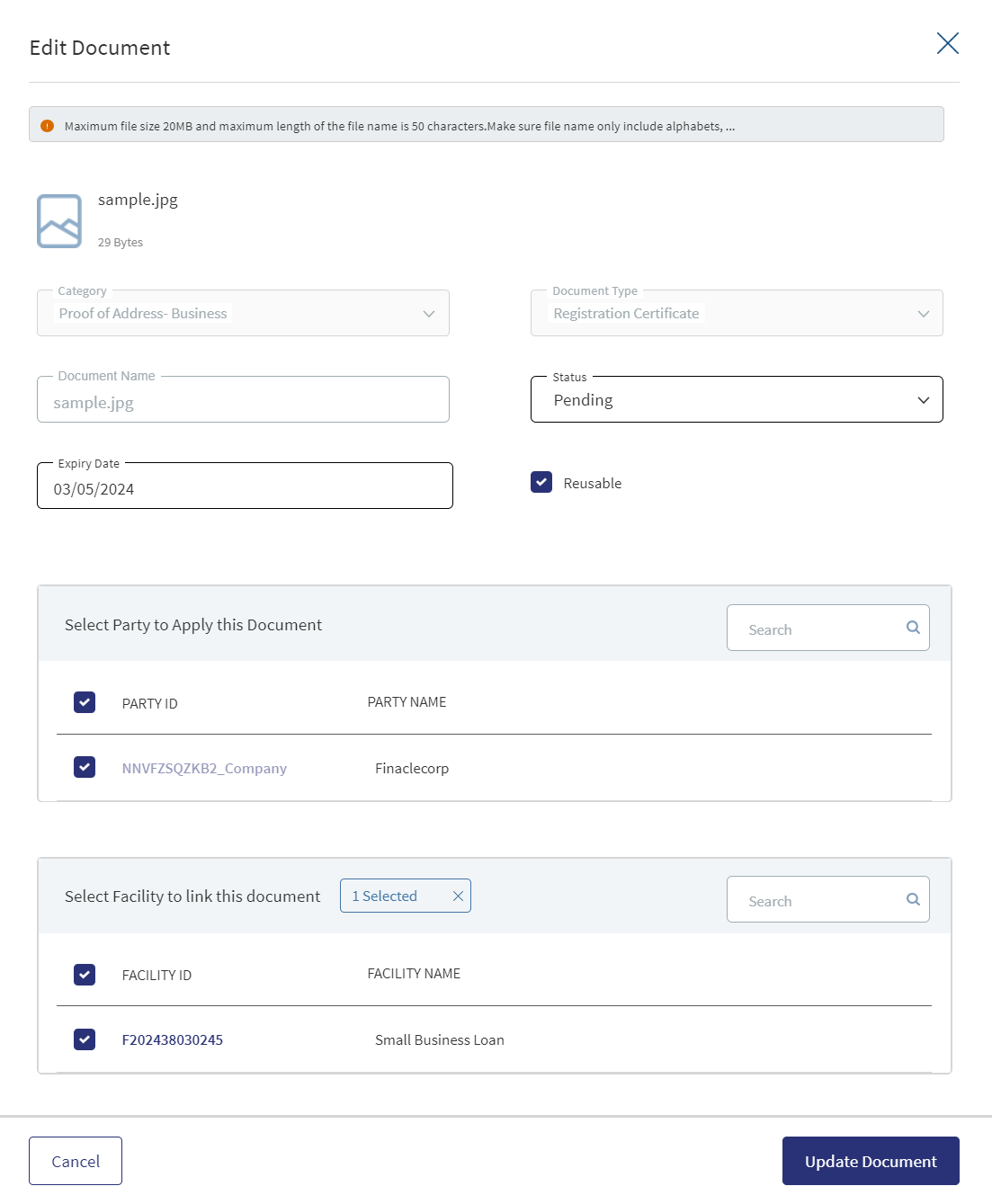

- Click Edit to modify the details. The document with Pending/Signed status only can be edited.

- Click Delete to remove the record. The document with Pending status only can be deleted. In the confirmation pop-up that appears, click Yes. The record is removed.

- On the Documents list screen, click Upload.

- The Upload button is available only under “Uploaded Document” sub section.

- In the Document section, the Bank user can add single/multiple documents as required.

- The Applies to displays depending on the Document Type chosen. The mapping between Document Type and Applies To is done in DMN.

- The “Linked To” field is by default the Facility ID.

- The “Upload” option is available for the logged in user depending on the permissions of the role.

- A confirmation pop-up appears that the maximum file size can be up to 25 MB and the file name can be alphanumeric without any spaces. Click Yes.

- A window to upload the document is displayed.

- Select the file to upload. The file name can contain alphanumeric characters and cannot contain spaces. The document types can be PDF, TXT, JPG, PNG, and JPEG. The maximum size allowed per document is 25 MB. The application displays a error message if incorrect document type is selected. In this case, click Add New Document to continue with the document upload.

- The Add Document screen is displayed. All fields are mandatory.

- Enter the Document Name.

- Select the Document Type (for example, Financial Statements, Amendments). Below is the sample modification agreement document that needs to be uploaded once the applicant accepts the changes for the Request.

- Select the Category from the list.The document is attached to the selected category level.

- The application displays the list, depending on the selected document category. Select the category to apply to the document. The selection can be one, many, or all.

- In Facility Overview, it does not display all the facilties, it displays by default the facility in the Facility Overview.

- If category is entity, this field lists all the entities related to the request. Defaults if this list has one value.

- If category is collateral, this lists all the collateral related to the request. Defaults if this list has one value.

- Select the Status from the list - Approved, Pending, Signed, Delivered, and Reviewed.

- The Applies to field is displayed based on the chosen Document Type. The mapping between Document Type and Applies To is done in DMN.

- The Expiry Date (mandatory) needs to be updated while adding a document. For the documents uploaded through “Origination App” this field remains blank, however when the bank user edits the uploaded document this field becomes mandatory.

- The Linked To field is by default the Facility ID.

- If an entity related document is uploaded from the Origination page, it displays in Entity Overview, Request Overview, Facility Overview for the linked facility.

- If a facility related document is uploaded from the Origination page, it displays in Request Overview, Facility Overview of linked facility.

- If a collateral related document is uploaded , it displays Entity Overview of the Collateral owner, Request Overview, Facility Overview of the linked facilities.

- No request related document is displayed in the Facility overview document section.

- The Add option for the logged in user depends on the permissions of the role.

- Click Upload Document. The application displays a confirmation message that the document is uploaded successfully. The document is added to the documents list. If the document category is applied to entity record, then the document is displayed in the document summary under respective entity overview only.

- An Adhoc document can be uploaded from any Overview(Entity, Request, Facility).

The document with Pending status only can be edited.

- Only the document Status, Linked To can be edited.

- Select the Status from the list - Approved, Pending, Signed, Delivered, or Reviewed.

- The status : Pending and Signed are editable.

- The Link To is default to the facility (for the Facility Overview) , hence user will be not be able to edit it, if no option is selected the system displays an error.

- Click Update Document to save the details.

- The application displays a confirmation message that the document details are updated successfully.

- If the Link To is Edited and if the Facility is removed then that document will not be visible in Facility Overview and Request Overview, however it is visible in the Entity Overview.

- The Edit option for the logged in user depends on the permissions of the role.

Click Cancel to discard the changes. On the confirmation pop-up that appears, click Yes. The changes are not saved.

The documents uploaded by the Customer / bank user or generated by the system, bank user in the Document Section can be viewed by clicking the View Document option.

The Document Category with an accordion view displays : Document Type, Document Name, Applies to, Status.

When clicked on the documents in the row the following fields display:

- Document Category

- Document Type

- Actual Document

- Document Name

- Applies To

- Linked To

- Document Expiry date

The Facility ID is default in the Linked to Field. The view option for the logged in user depends on the permissions of the role.

A Bank user will be able to View documents uploaded through Customer Action in the “Uploaded Document” section in Entity Overview, Request Overview and Facility Overview based on the Document Category and Type.

The uploaded Adoc Documents can also be viewed in this section, however they are not displayed in the Checklist or the Checklist Icon.

The Bank user will be able to delete the uploaded /system generated documents. The Delete option is enabled only for the documents with status pending. Once the document is deleted based on the Link To, all the documents will be delinked and deleted from the Entity , Request and Facility Overview. The Delete option for the logged in user depends on the permissions of the role.

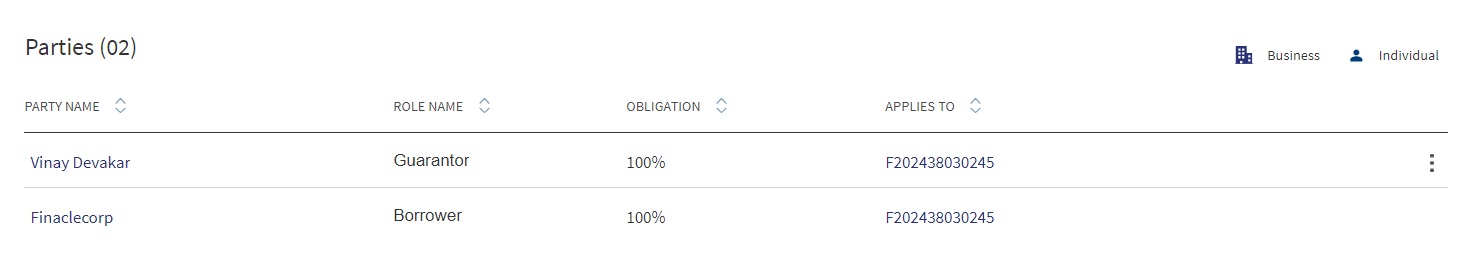

Parties

The application displays the list of parties already added to the facility with the following details. The parties added in request overview are displayed in the request overview and changes done here reflects in the facility overview and vice versa.

- Party name. Click to view the entity overview details.

- Role Name of the entity (for example - Borrower) with the facility/Modification Facility. The drop down for Role consists of the following:

- Add as party

- Add New party

- Edit existing party

- Edit party

- Add role (group party)

- Edit role (group party)

- Obligation to the request in percentage or as an amount. For borrower, it is 100 percent always and for other roles, it is as defined in the party screen.

- Applies to a request or a facility. Click the ID to view the overview details

Do any of the following:

- Click the row to view the party details.

- Click the Party Name link to view the entity details.

- Click Add Party to add a party to the request. There can be only one borrower role per facility. The other parties will be other roles such as co-borrower, guarantor and more.

- The Addition and Release Party requested during Onboarding are prepopulated along with add/release icon.

- For all the prepopulated Parties only Release (or) Retain option are displayed in the contextual menu.

- User can view the change request indication along the columns in Party section.

- User can view icon indications for Party modifications of existing facilities - Add, Release.

- Retain option is to reverse the release request. On clicking Retain option, it will remove the release icon indication for the line item and release option will appear again

- Release option in the contextual menu should be changed to 'Retain' option

- Retain option is to reverse the release request. On clicking Retain option, it will remove the release icon indication for the line item and release option will appear again

- If a Borrower Role is already added to a Facility/Modification Facility, when navigated to the Add party/Edit party screen, the borrower Role will not be listed in the dropdown.

- In a Modification Facility Overview, a User can add the same party with a different role if the already added role of the party is released.

- If there is No Release/Add request noticed for the Party,When the User clicks on Add Party button and navigates to add party screen, the same party will not be listed in the existing parties for selection.

- If the Party is linked to the facility with a Role and the Release of the Role is requested, When the User clicks on Add Party button and navigates to add party screen, the same party will be listed in the existing parties for selection.

- If the Party is linked to the facility with a Role and the Release is requested, further if the role addition of the same party is already requested with different role Add Requestthen if the User clicks on Add Party button and navigates to add party screen, the same party will not be listed in the existing parties for selection.

- Use the context menu as required:

- Click Edit to modify the details. A borrower record cannot be edited.

- Click Delete to remove the record. In the confirmation pop-up that appears, click Yes. The record is removed. A user can delete the parties linked with the facility at a request. However, a user cannot delete the Request Borrower/applicant and the Party with role as Borrower.

- Prepopulated parties linked to existing facilities do not have context menu.

The User can view all the approved Party modifications in the Parties section post approval after the deploy changes auto task take place.User can navigate to the View Party screen by clicking the row.

- If a user has added Party in the Parties section where Add Icon displays and is approved by the Underwriter in the Decision section in this case post approval the Add Icon does not display in the Parties section.

- If a user has added Party in the Parties section where Add Icon displays and is declined by the Underwriter in the Decision section in this case post decline no line item details display in the Parties section.

- If a user has released Party in the Parties section where Release Icon displays and is approved by the Underwriter in the Decision section in this case post approval the Release Icon does not display in the Parties section.

- If a user has released Party in the Parties section where Release Icon displays and is declined by the Underwriter in the Decision section in this case post decline the Release Icon does not display in the Parties section.

Credit

This section explains the following:

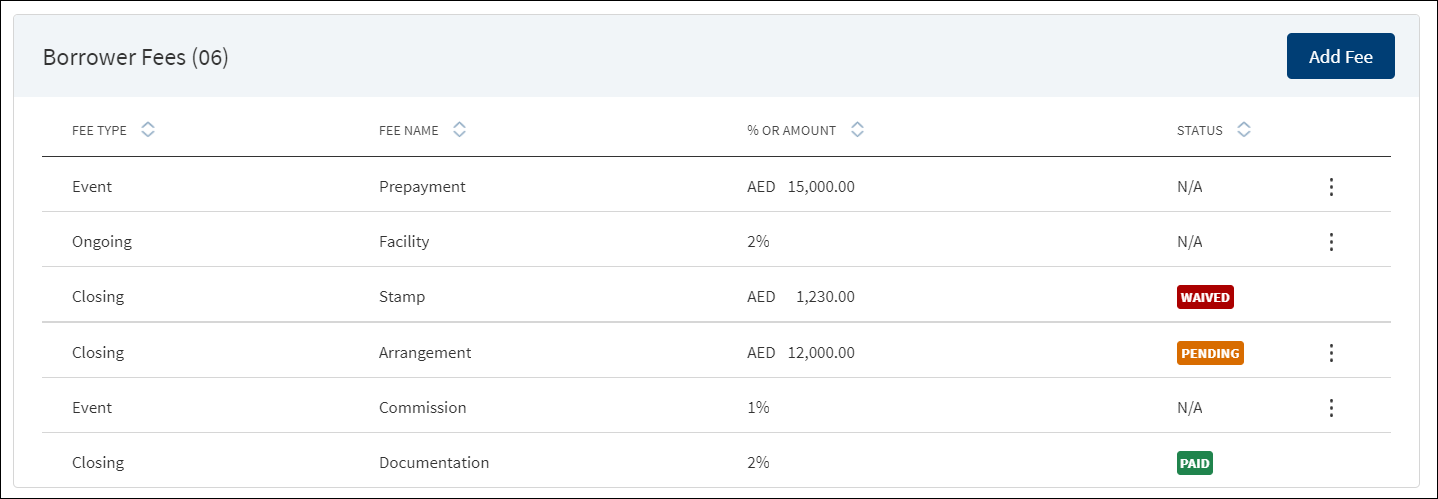

Borrower Fees

A bank user of relationship manager and underwriter roles with the necessary permissions can view and manage (add, view, edit, delete) the feature.

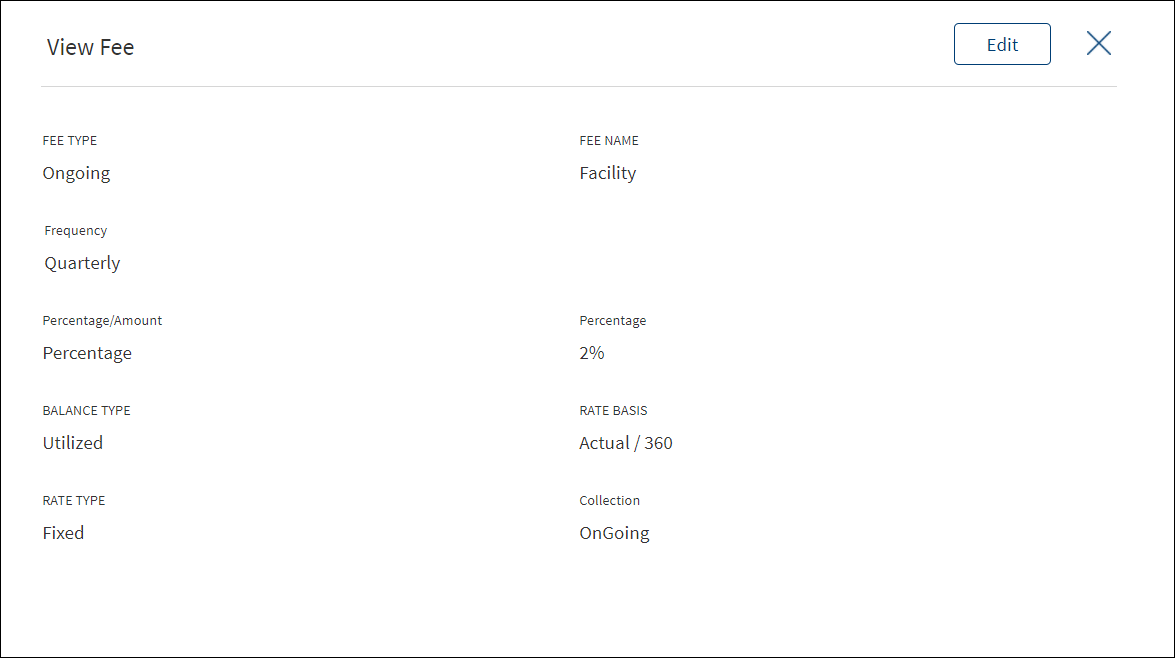

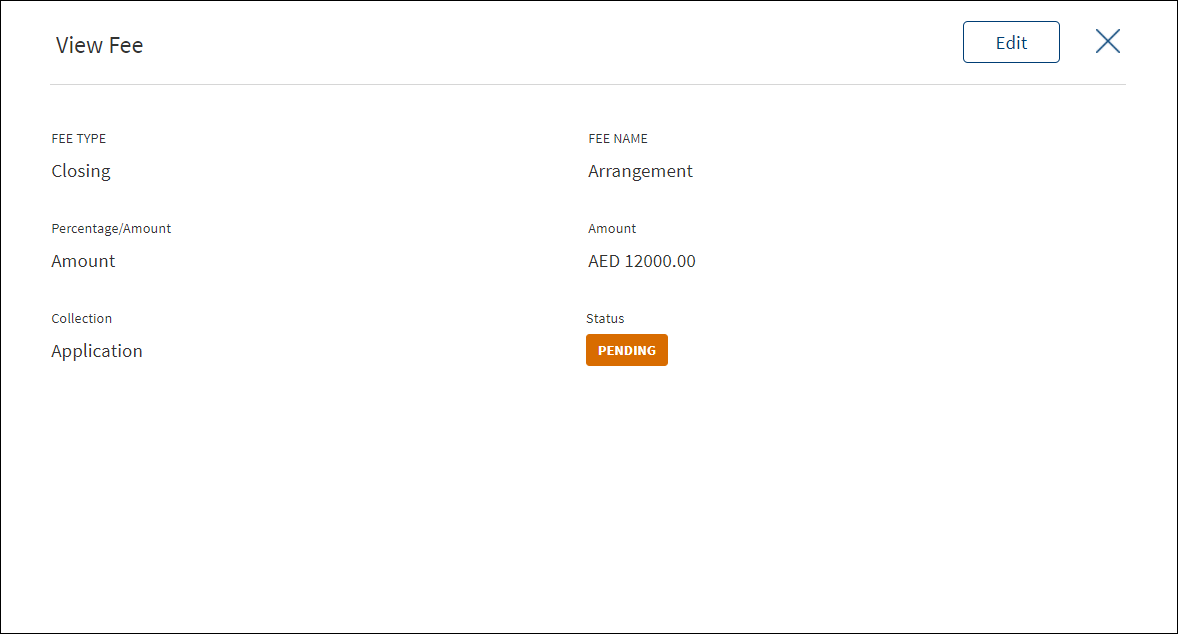

The application displays the borrower fees for the facility and modified facility with the following details: Fee Type, Fee Name, % Or Amount, and Status (only applicable for closing fees).

In case the Product already has the Borrower fees in MCMS , the system displays the Applies To accordingly. The Applies To section displays the Product ID in the Product level.

Do any of the following:

- Context menu: Use the context menu as required:

- Click Edit to modify the details.

- Click Delete to remove the record. On the confirmation pop-up that appears, click Yes. The record is removed from the borrower fee list. Records with Paid and Waived status cannot be deleted.

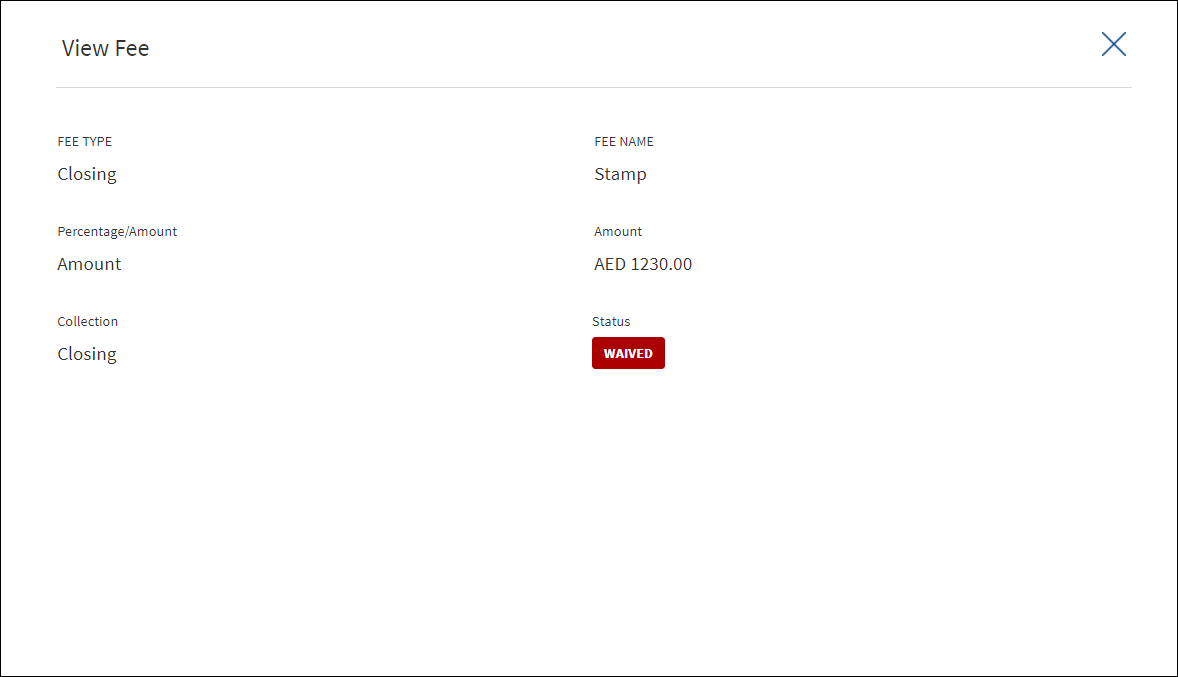

- View Borrower Fee: Click the row to view the borrower fee details. For example, the fee name can be Penalty Interest, Commission, Stamp, Arrangement and more.

- Click Edit to modify the fee details. A fee with status as Paid or Waived cannot be edited

- Click X to close the screen.

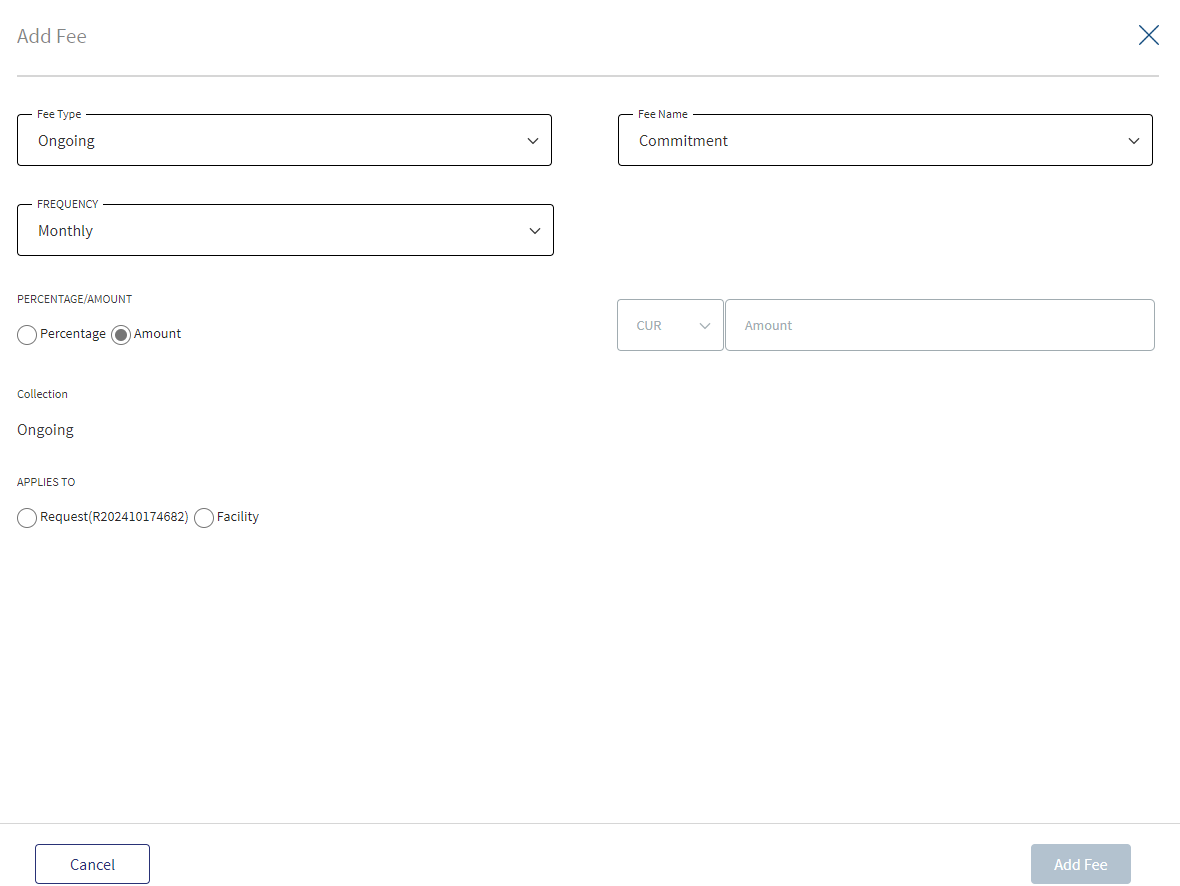

- Click Add Fee to add a new borrower fee.

Use the feature to add borrower fee details. a fee added in facility overview is displayed in request overview as well.

- Select the Fee Type from the list. The application displays various options depending on the selected fee type.

- Ongoing

- Select the Fee Name from the list (for example, Available, Facility, Utilized).

- Select the Frequency from the list.

- Select fee as a Percentage or Amount. If Amount is selected, then select the currency from the list and enter the Amount. The currency field has predictive search where you can enter your option in the box and select the required option from the matching result rather than scroll down the list to select a currency.

- Rate Basis: Visible only if percentage is selected in percentage/amount.

- Balance Type: Visible only if percentage is selected in percentage/amount

- Rate Type: Default to Fixed, Visible only if percentage is selected in percentage/amount.

- By default, the application applies the Collection as Ongoing.

- Event

- Select the Fee Name from the list (for example, Documentation, Penalty Interest, Commission).

- Select fee as a Percentage or Amount. If Amount is selected, then select the currency from the list and enter the Amount. The currency field has predictive search where you can enter your option in the box and select the required option from the matching result rather than scroll down the list to select a currency.

- Basis: Visible only if percentage is selected in percentage/amount. The following list items are available - Facility Amount and Prepayment Amount.

- Closing

- Select the Fee Name from the list (for example, Arrangement, Documentation, Stamp).

- Select fee as a Percentage or Amount. If Amount is selected, then select the currency from the list and enter the Amount. The currency field has predictive search where you can enter your option in the box and select the required option from the matching result rather than scroll down the list to select a currency.

- Basis: Visible only if percentage is selected in percentage/amount. The only list item available is Facility Amount.

- Select the Collection Type from the list.

- Select the Status from the list - Pending, Paid, Waived, and N/A.

- Ongoing

- On changing the Fee Type, the application displays a confirmation pop-up for switching the fee type. On clicking Yes, the data entered so far will be lost.

- Click Add Fee. The application displays a confirmation message that the fee is added successfully and adds the record to the Borrower Fees list.

Click Cancel to discard the changes. On the confirmation pop-up that appears, click Yes. The changes are not saved.

Use the feature to edit the borrower fee details. A fee with status as Paid or Waived cannot be edited.

- Make the changes as required. The Fee Type and Fee Name cannot be edited.

- The following details can be edited depending on the fee type: Fees Percentage or Amount option, Basis request amount, Percentage, Amount, Collection, and Status.

- Click Update Fee to save the details.

- The application displays a confirmation message that the record is updated successfully. The updated borrower fee details are displayed on the view screen.

Click Cancel to discard the changes. On the confirmation pop-up that appears, click Yes. The changes are not saved.

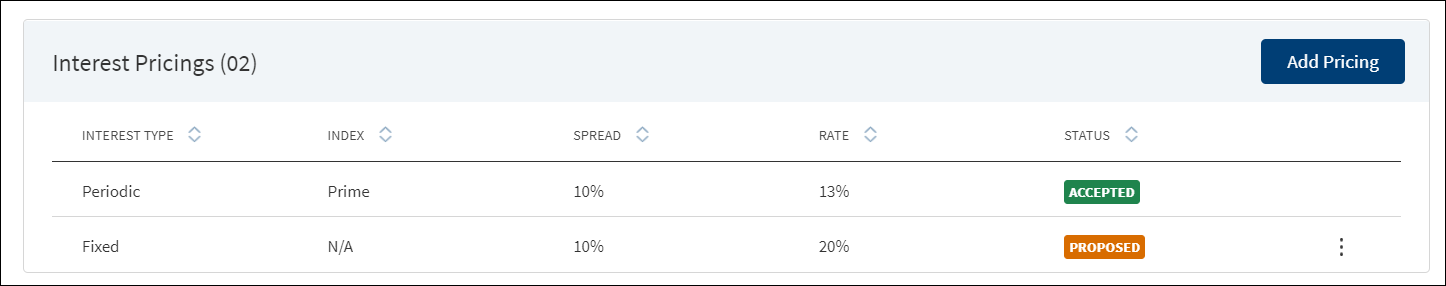

Interest Pricing

A bank user of relationship manager, underwriter, and supervisor roles with the necessary permissions can view and manage (add, edit, delete) the feature. The feature is not applicable for Letter of Credit and Letter of Guarantee products and the application displays an appropriate message.

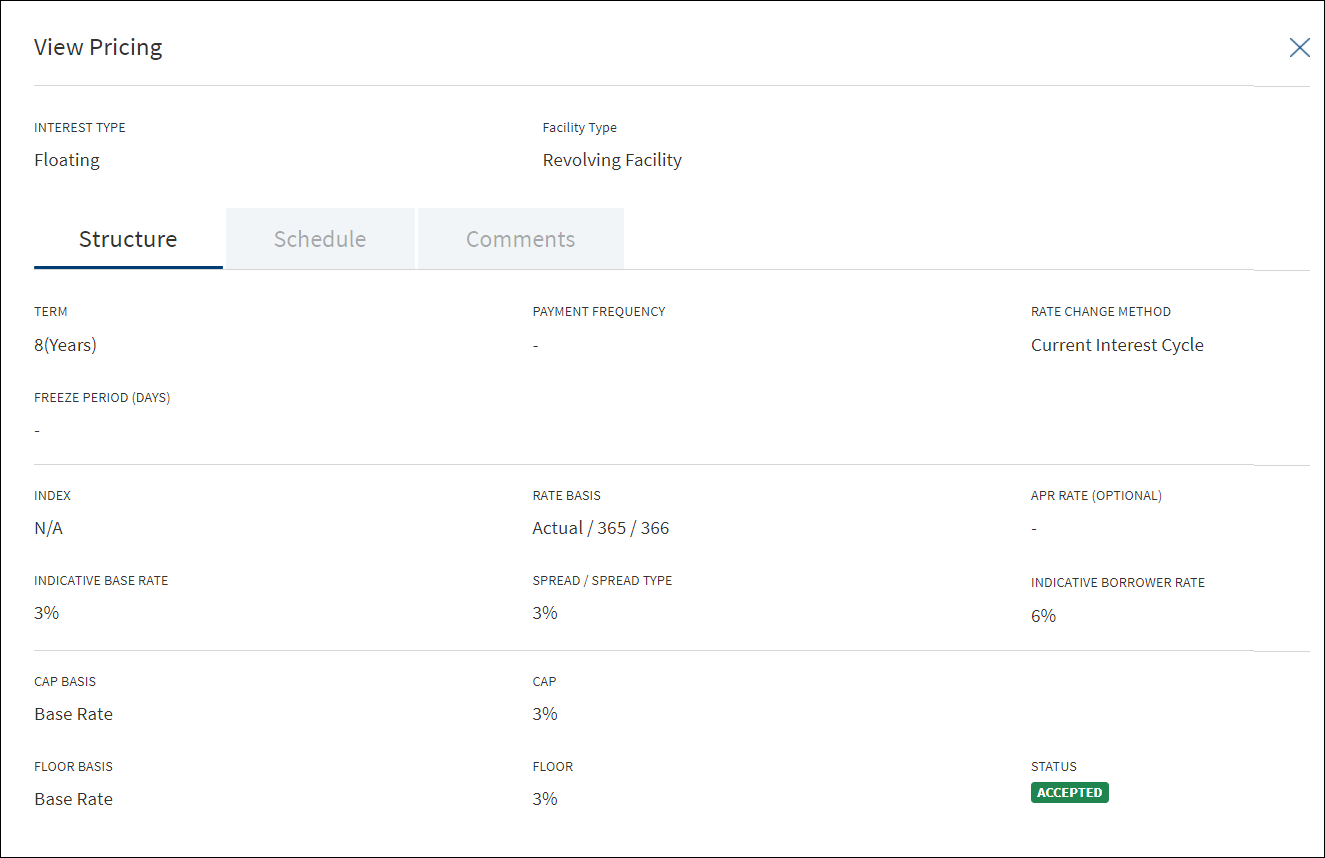

The application displays the margin charged to the customer with the following details: Interest Type, Index, Spread or margin, Rate of interest, and Status (Accepted, Rejected, and Proposed). For a Facility or Modified Facility, there can only be one pricing with an accepted state and only the accepted pricing is sent to the core banking system. Only a Supervisor can modify the accepted pricing. The Offer Acceptance stage is not applicable for Modification Facility, It is moved to the due diligence status, after underwriting is completed.

Do any of the following:

- View Pricing:

- Click the row to view the pricing details. For the list of fields on the Structure and Schedule tabs for different interest types and facility types, see the attached document.

- If there is a document attached to repayment schedule (for term and mortgage loan), the document is displayed and can be downloaded on the Schedule tab.

- View the comments entered by the user on the Comments tab.

- Click Edit to modify the details. The Edit option is available only if the status is Proposed or Rejected.

- Click the row to view the pricing details. For the list of fields on the Structure and Schedule tabs for different interest types and facility types, see the attached document.

- Context menu: Use the context menu as required:

- Click Edit to modify the details. Records with Accepted status cannot be edited.

- Click Delete to remove the pricing details record. On the confirmation pop-up that appears, click Yes. The record is removed from the pricing list. Also, the document attached to the repayment schedule, if any is also deleted (applicable for term and mortgage loan). Records with Accepted status cannot be deleted.

- Context Menu is not applicable for Modified Facility as all the fields are prepopulated and cannot be edited.

- Add Pricing: Click Add Pricing to add pricing details. Not applicable for Letter of Credit and Letter of Guarantee products.

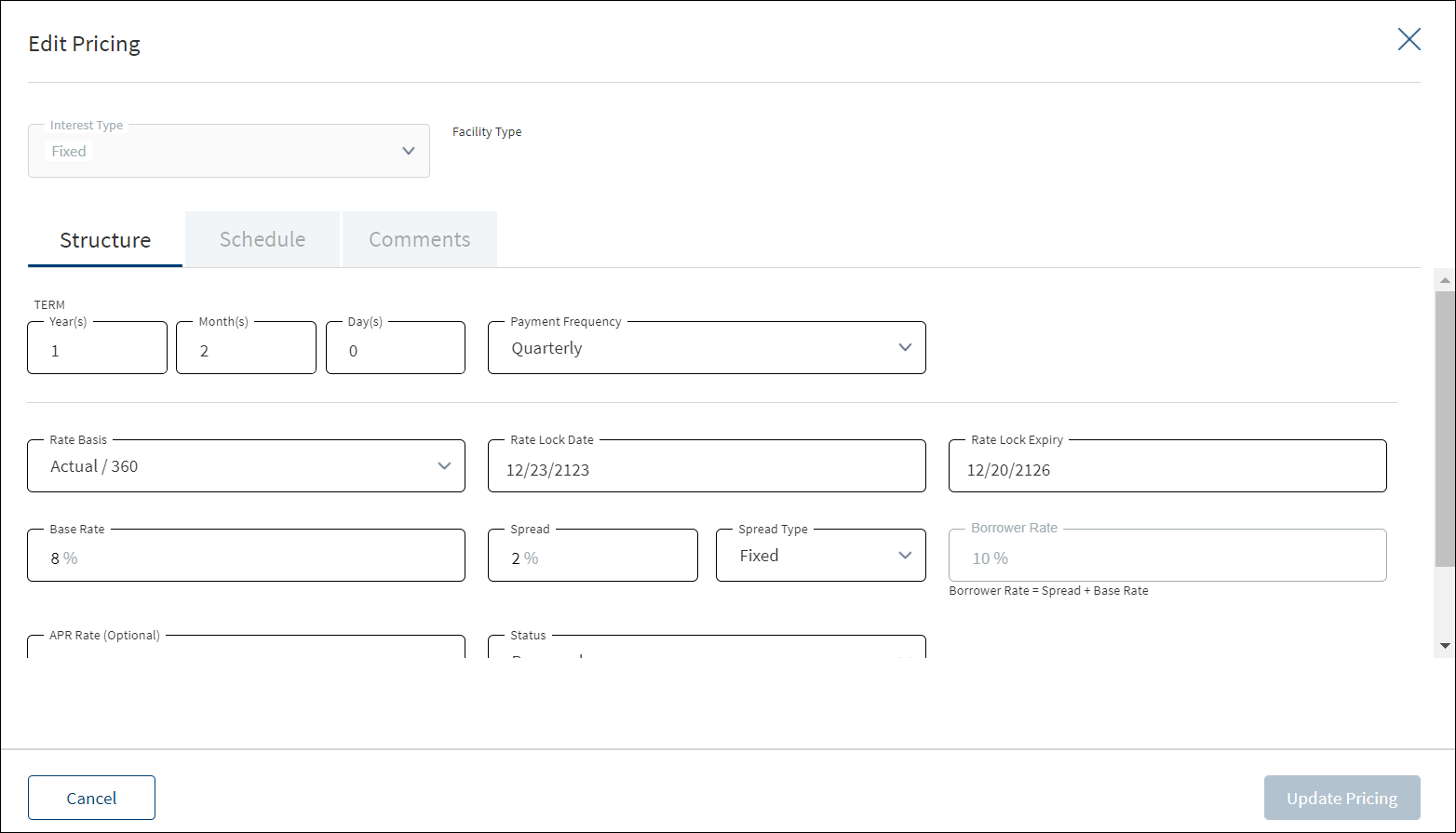

Use the feature to edit the pricing details if the status is Proposed or Rejected.

- On the context menu, click Edit. Alternatively, click the Edit button to modify the pricing details. The records with Proposed or Rejected status only can be edited.

- Make the changes as required on the Structure, Schedule, and Comments tabs.

- The fields are displayed on the Structure tab based on the interest type. The following details cannot be edited: Interest Type, Facility Type, Borrower, and Indicative Borrower Rate.

For the list of fields on the Structure and Schedule tabs for different interest types and facility types, see the attached document.

- The fields are displayed on the Schedule tab based on the interest type and facility type.

- The following details cannot be edited: Interest Type and Facility Type.

- If required, delete Repayment Schedule document, if any and upload a new document (applicable for term and mortgage loan). The procedure to upload a document and the validations are explained under Add Pricing section.

- Click Update Pricing to save the details. Make sure that all the mandatory fields are filled.

- The application displays a confirmation message that the record is updated successfully.

Click Cancel to discard the changes. On the confirmation pop-up that appears, click Yes. The changes are not saved.

A user with signed-in bank user with the necessary permissions can add pricing details for all the facility types except Letter of Credit and Letter of Guarantee products.

The application displays the following tabs to capture the pricing details:

- Structure

- Schedule

- Comments

To add pricing, follow these steps:

- On the Interest Pricing list screen, click Add Pricing.

- The application displays the following:

- Facility Type or Product (for example, Revolving Facility, Term Facility) and the Interest Type list. The list items are based on the facility type or product.

- The following tabs: Structure, Schedule, and Comments.

- Select the Interest Type from the list. The list items are based on the facility type or product.

- For Term Loan and Mortgage Facility, the following interest types are applicable: Fixed, Periodic, and Floating.

- For Revolving, Line of Credit (non revolving), and Overdraft, only Floating interest type is applicable.

- Provide the details based on the selected interest type on the Structure, Schedule, and Comments tabs.

- Structure tab: The List of fields appearing on the Structure tab is based on the selected interest type. For the list of fields on the Structure tab for the selected Interest Type, see the attached document.

- Schedule tab

- For Term and Mortgage Loan facility types, see the attached document for the list of fields on the Schedule tab.

- For Repayment Schedule, click Upload to upload a document. A confirmation pop-up appears with file name conditions (alphanumeric characters without space), maximum file size (25 MB), and allowed document types (jpeg, jpg, png, pdf, txt) for uploading a document. Click Okay.

- Browse and upload a document. The application displays an error message if a wrong document type is uploaded. The uploaded document appears under Repayment Schedule section.

- Click the document name to download the document and delete the document if required.

- Only one document can be uploaded at a time. The document upload option is disabled after a document is uploaded.

- To upload another document, delete the existing document and then upload the new document.

- The document must be saved before adding the pricing details.

- For Revolving Facility, Line of Credit (non revolving), and Overdraft facility types, see the attached document for the list of fields on the Schedule tab.

- For Term and Mortgage Loan facility types, see the attached document for the list of fields on the Schedule tab.

- Add comments on the Comments tab if required. It is optional. When a lengthy comment or description is entered which does not fit the field, then the content moves to the next line of the field. The field accepts up to 500 characters.

- Click Add Pricing. Make sure that all the mandatory fields are filled. The application displays a confirmation message that the pricing is added successfully. The details are added to the Interest Pricing list.

- After entering the details, the user can select a different interest type if required. The application displays a warning message. Click Yes to change the interest type. The saved data is lost. The fields change based on the new interest type.

- Click Cancel to discard the changes. On the confirmation pop-up that appears, click Yes. The changes are not saved.

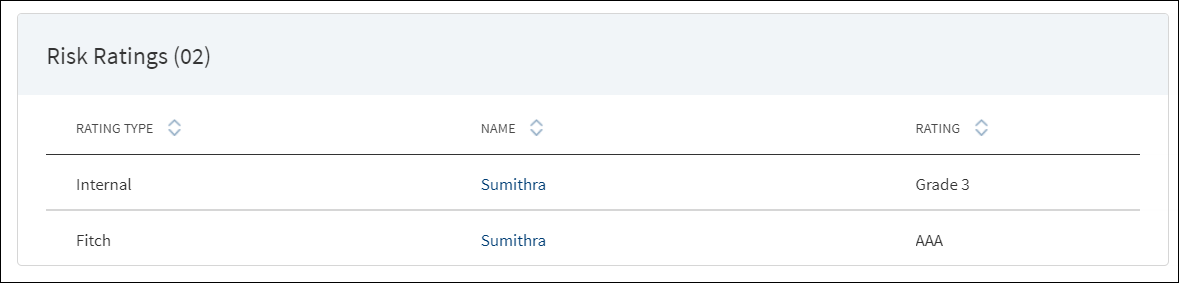

Risk Ratings

Risk Rating is applicable for both New Facility and Modified Facility, After submitting the onboarding request, the application fetches the related parties of the request with their ratings, and then automatically populates the information with the following details: Rating type, Entity name, and Rating given by the bank. The Adjustment Rating is displayed if available, otherwise the New Rating is displayed. The History button on the screen displays the Risk Rating from the previous Facility. It provides the following details:

- Rating Type

- Date

- Rating

Do any one of the following:

- Click the entity name to view the entity details.

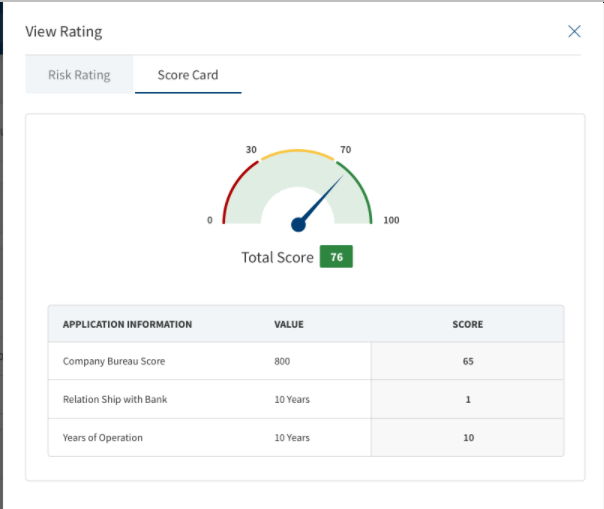

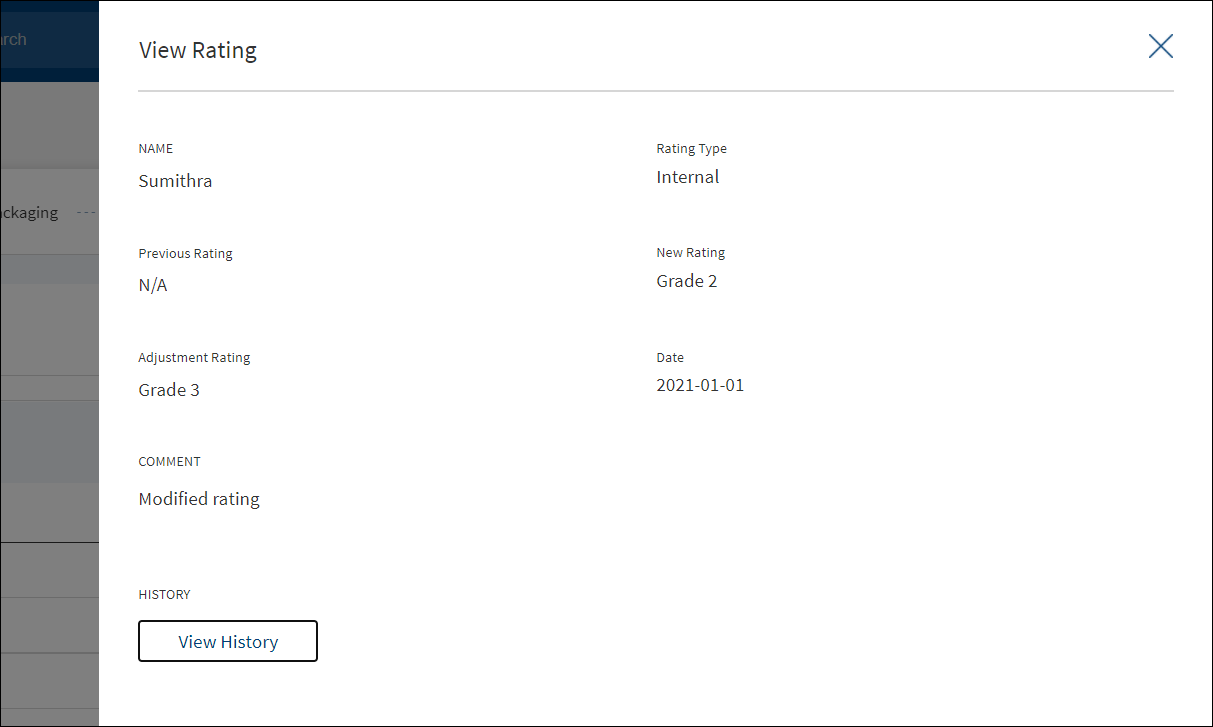

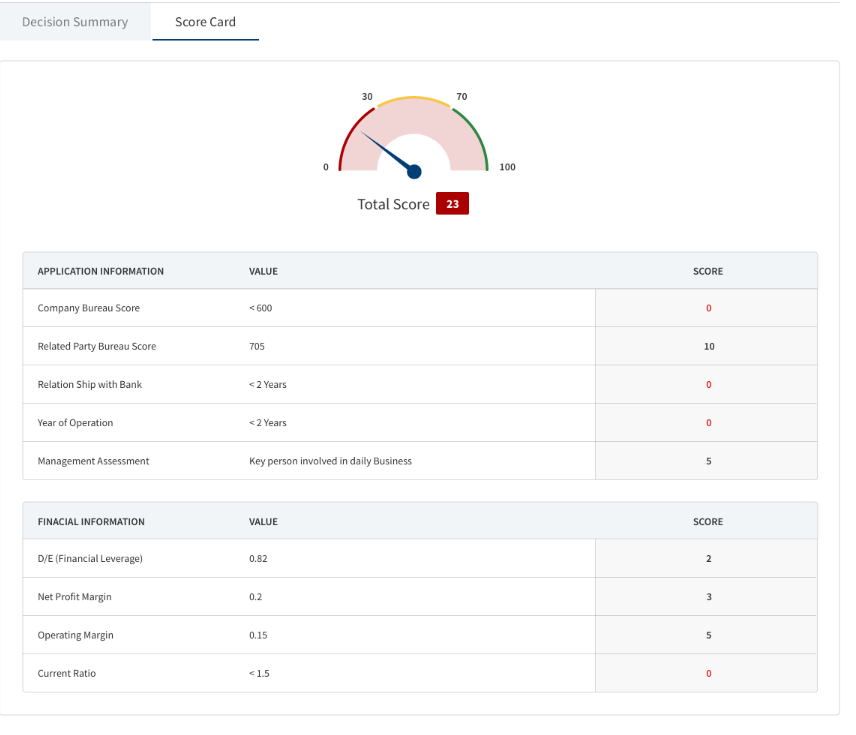

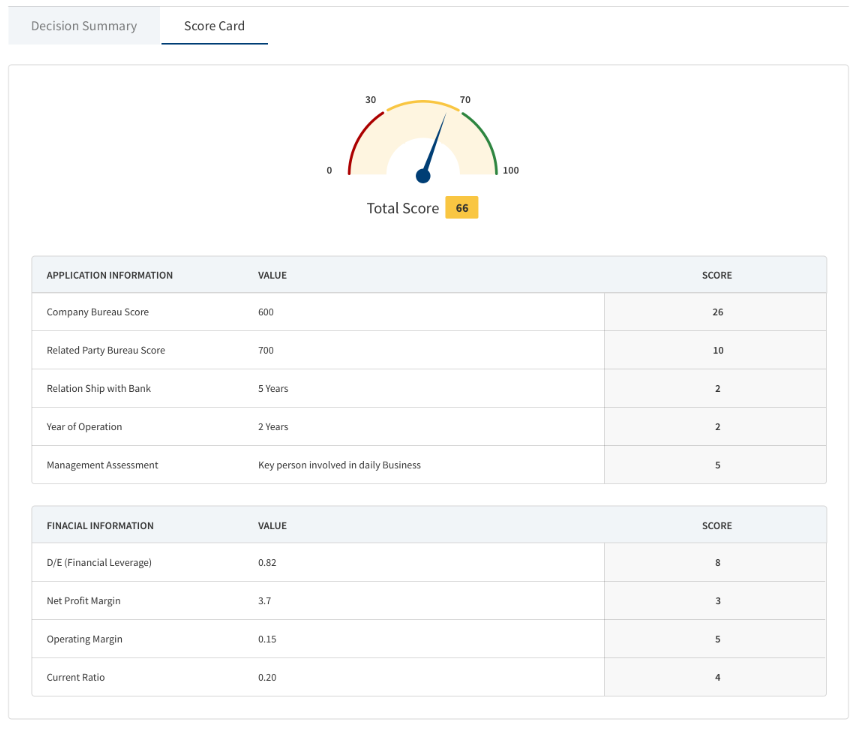

- Click the row to view the rating details. The application displays two sections: Risk Rating and Score Card.

- Risk Rating displays the following details: Rating Type, Previous Rating, New Rating, Adjustment Rating, Date, Comment, and History button.

- Score Card: This section displays the Total Score eligibility for the Entity. The value ranges from 0 TO 100. It displays the following fields: Application Information, Value, Score. This is a non-editable section. Since this section is controlled by permissions ,only if the logged in user has requisite permission only then the Score card can be viewed else it is not displayed. This Data is taken from riskScoreCard API in LOS MS.

- Click View History to view the historical ratings.

- Click X to close the form

The risk score rules are defined in DMN and is the total of variables like individual bureau score, years of operation, etc for the respective Applicant (business and individual party).

DMN Rules

| Rating Type | Rating Score | Eligibility | Risk Category |

|---|---|---|---|

| Internal | Grade 1 | >80 | Low |

| Internal | Grade 2 | 71-80 | Low |

| Internal | Grade 3 | 61-70 | Medium |

| Internal | Grade 4 | 51-60 | Medium |

| Internal | Grade 5 | 41-50 | Medium |

| Internal | Grade 6 | 31-40 | Medium |

| Internal | Grade 7 | 21-30 | High |

| Internal | Grade 8 | <20 | High |

The Score Card section is currently applicable only for SME.

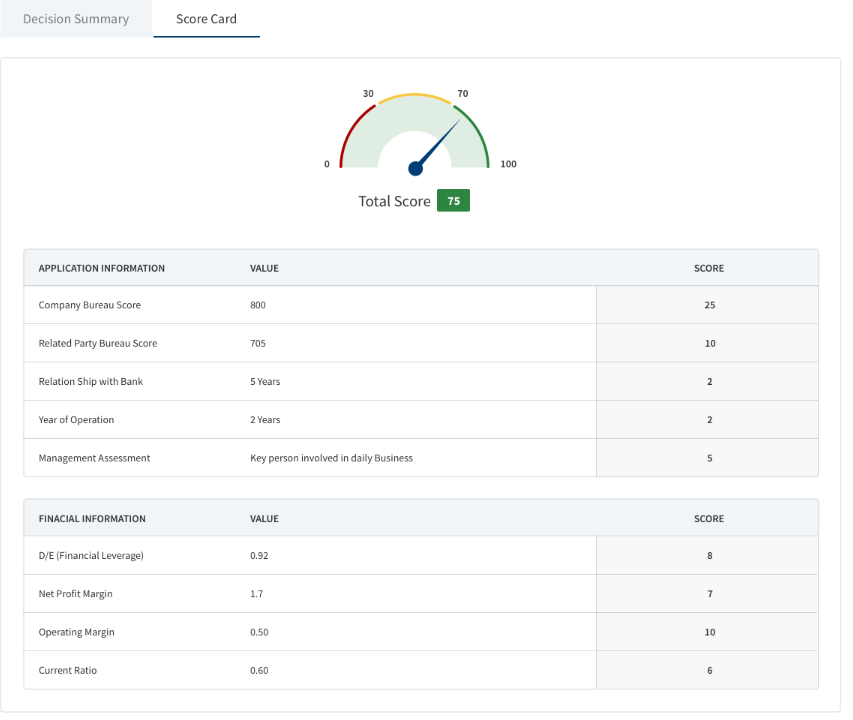

Decisions

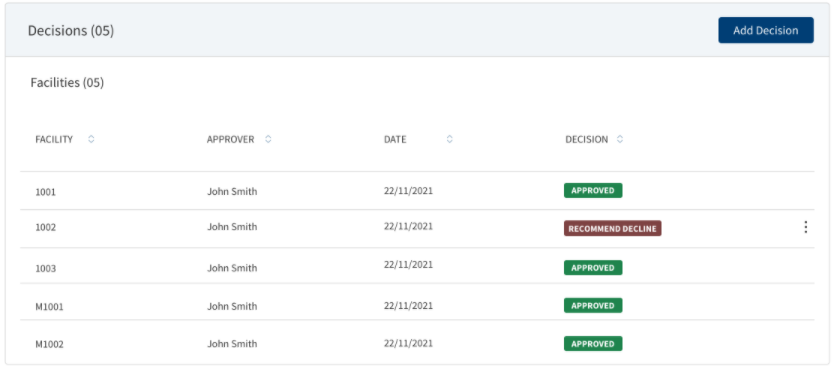

Using the feature, a bank user with underwriter and supervisor roles can take individual or committee decisions in a bank for single and multiple facilities in a request. The application displays the summary of all decisions for all the facilities or all the modifications that are requested within a request.

For more information on credit score and automated decision rules, click here.

The application displays the following details:

- Facility ID

- Approver: Shows the approver name in case of Individual approving it. In case of Committee approval, the Committee Name is displayed.

- Date: The Date the decision was saved.

- Decision: The decision accorded. The values are:

- Individual decision: Recommend Approve, Recommend Decline, Approve, and Decline.

- Committee decision: Committee Pending, Committee Approve, and Committee Decline

The application also displays the list of corresponding conditions with the following details: Facility ID, Condition Type, Condition Name, Requirement, and Status.

When the same decision and conditions are added to multiple facilities, in the summary view, the decision and condition are displayed facility-wise in multiple rows.

The application displays the following details for Modification Facility:

- Under review - Until requests are approved or declined (Pre-approval)

- Approved - If all the modification requests are approved

- Decline - If all the modifications are declined

- Partially approved - If few modification requests are approved and few are declined.

The application displays two sections: Decision record and Score Card.

Decision section displays the following details: Approver, Decision Date, Expiration Date, Facility ID, Product, Requested Amount, Decision, Approved Amount.

Score Card: displays the following details:

- Application Information, Value ,Score.

- Financial Information , Value, Score.

This is displayed only in the case of automated Decisions. In case the Decisions are not automated ( for Corporate Lending) , this section does not display. This is a non-editable section, Since this section is controlled by permissions ,only if the logged in user has requisite permission only then the Score card can be viewed else it is not displayed.

Do any of the following:

- Use the context menu placed against the conditions as required:

- Click Edit to modify the summary details. User who added the condition only can update the condition summary details. A condition with Pending status only can be edited. Only users with the required permission can edit a record.

Menu path: Request Overview > Credit > Decisions> Edit Decision and Condition - Click Delete to remove the record. A condition with Pending status only can be deleted. In the confirmation pop-up that appears, click Yes. The record is removed. Only users with the required permission can delete a record.

- Click Edit to modify the summary details. User who added the condition only can update the condition summary details. A condition with Pending status only can be edited. Only users with the required permission can edit a record.

- Click the row to view the details.

Menu path: Request Overview > Credit > Decisions> View Decision Details - Click Add Decision to add a new decision and condition.

Menu path: Request Overview > Credit > Decisions> Add Decision and Condition

Once underwriter approves the requested modifications, the User can view tool tip displaying the status -requested and approved by Underwriter. For approved status - Increase in Loan amount ,Change in Maturity date.

The User can view tool tip displaying the status - requested and approved in both Add Decision and View Decision section in the Facility Overview Screen.

Monitoring

This section explains the following:

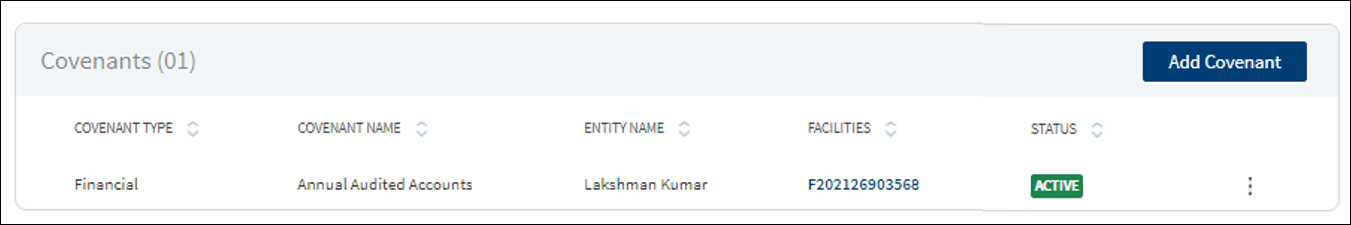

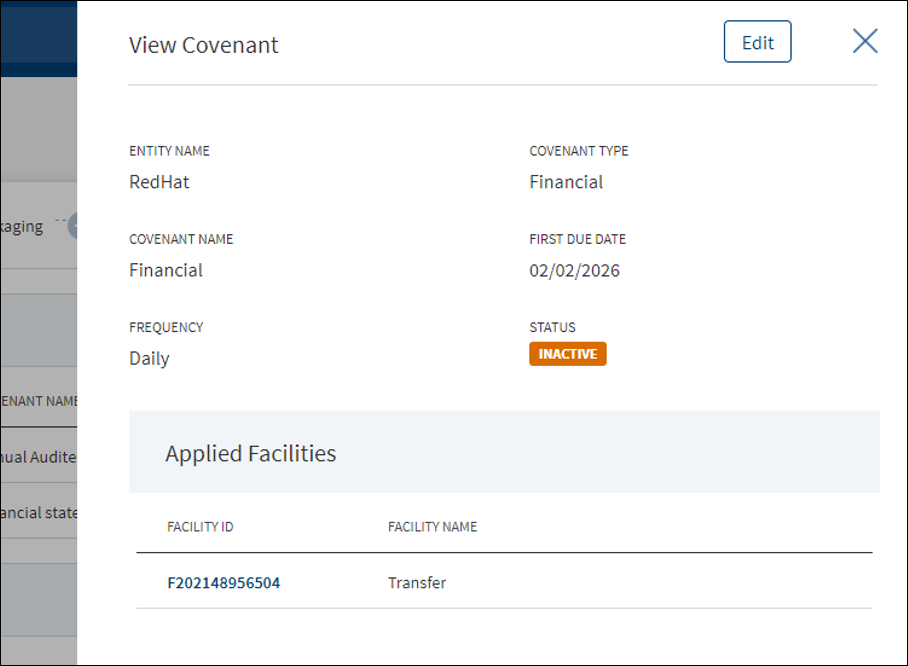

Covenants

The application displays a summary of Covenants that are linked with the Modification Facility, Facility covenants or the tracking conditions for an entity with the following details: Covenant Type, Covenant Name, Entity Name, Facilities, and Status. All active covenants are required to be tracked.

Do any of the following:

- Click Add Covenant to add a covenant.

- Context Menu is not available for prepopulated section as they cannot be edited.

- Use the context menu as required:

- Click Edit to modify the details.

- Click Delete to remove the record. The covenants with Active status cannot be deleted. In the confirmation pop-up that appears, click Yes. The record is removed

- Click the row to view the details.

- Click Edit to modify the details or click X to close the form.

- Click Edit to modify the details or click X to close the form.

The application displays the list of covenants already added for the parties with the following details: Covenant Name, Covenant Type, and Entity Name. Use the search bar to search for a specific covenant. This feature is not applicable for Retail lending requests and not visible to the bank user roles managing these requests.

Do any one of the following:

- Existing covenant: Add any existing covenant from the list.

- The application pre-populates the existing covenant details and displays the list of facilities to which the covenant can be applied.

- Select the required facility from the list. The selection can be one, many, or all items.

- Click Add Covenant. The covenant is added to the Covenants list.

- New covenant: Click Add New Covenant.

Add New Covenant Flow:

- Select the Entity Name from the list. The covenant will be associated with the selected entity and available in the entity overview screen.

- Select the Covenant Type from the list - Financial, Performance, Collateral, Borrowing base and more. For Performance covenant, enter the Operator and Requirement details.

- Select the Covenant Name associated with the Covenant Type from the list.

- Select the Frequency from the list - Daily, weekly, monthly and more.

- Enter the First Due Date in MM/DD/YYYY format. The application checks that the First Due Date is not less than the current date.

- Select the Status from the list - Active or Inactive. By default, Inactive is selected.

- The application displays the list of facilities to which the covenant can be applied. Select the required facility from the list. The selection can be one, many, or all items. Covenant Type with Covenant Name combination for a Facility is unique. A user cannot add more than one same combination for a Facility.

- Click Add Covenant. The application displays a confirmation message that the covenant is added successfully and adds the record to the Covenants list.

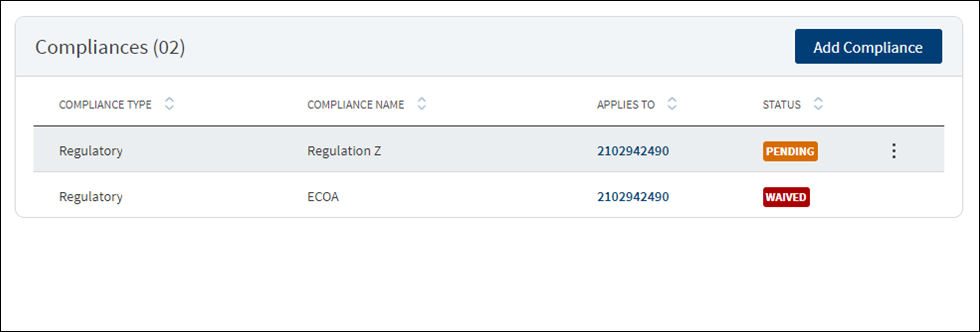

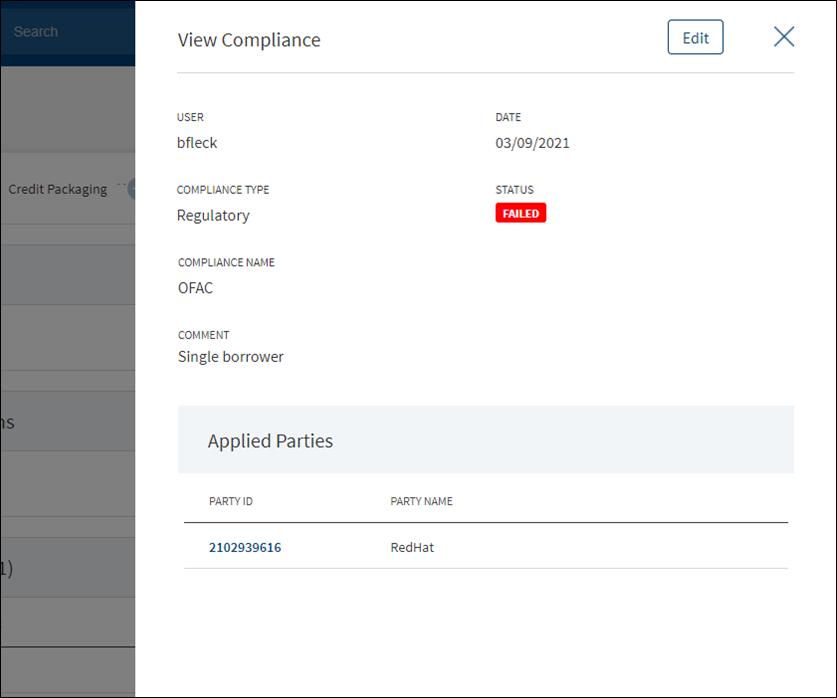

Compliance

The compliance can be third-party integration or manually handled. The application displays the current list of New Facilities and Modified Facilities for all compliance items that are required at this point of processing for review. This list indicates all relevant regulatory and internal compliance required. This section provides an automated overview of all compliance line items involved with the request up to the current processing stage. A user can add a compliance item and view the compliance result. The following details are displayed: Compliance Type, Compliance Name, Applies to which party or facility depending on the selected compliance type and name, and status.

Do any of the following:

- Click Add Compliance to add a compliance item.

- On the context menu, click Edit to modify the details. The items with Pending and Failed status only can be edited.

- Click the row to view the details.

- Click Edit to modify the details or click X to close the form. The items with Pending and Failed status only can be edited.

- Click X to close the form.

- The application displays the signed-in user name and the current date.

- Select the Compliance Type from the list - Regulatory and Internal.

- Select the status type from the list - Passed, failed, pending, and waived. If a third-party system is used, it is possible to pull the result directly from that system.

- Select the Compliance Name associated with the Compliance Type from the list.

- Add Comments. When a lengthy comment or description is entered which does not fit the field, then the content moves to the next line of the field. The field accepts up to 500 characters.

- The application lists the parties, facilities, or collateral depending on the selected compliance type and compliance name. Refer to the following examples. Select the required item. By default, one item is selected.

- Example: Compliance Type - Regulatory, Compliance Name - ECOA. Entities list is displayed.

- Example: Compliance Type - Internal, Compliance Name - Underwriting Guidelines. Facilities list is displayed.

- Example: Compliance Type - Internal, Compliance Name - Appraisal. Collateral list is displayed.

Compliance cannot be added/applied more than once to a Entity/Facility/Collateral. The Entity/Facility/Collateral to which the Compliance Name and Compliance Type combination is already applied is disabled and not available for the user to select.

- Click Add Compliance. The application displays a message that the compliance item has been added successfully and the compliance is added to the Compliance list.

Settlement

This section provides an overall view of the status of the following items:

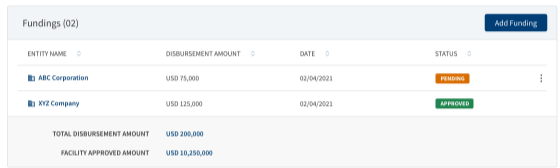

Funding

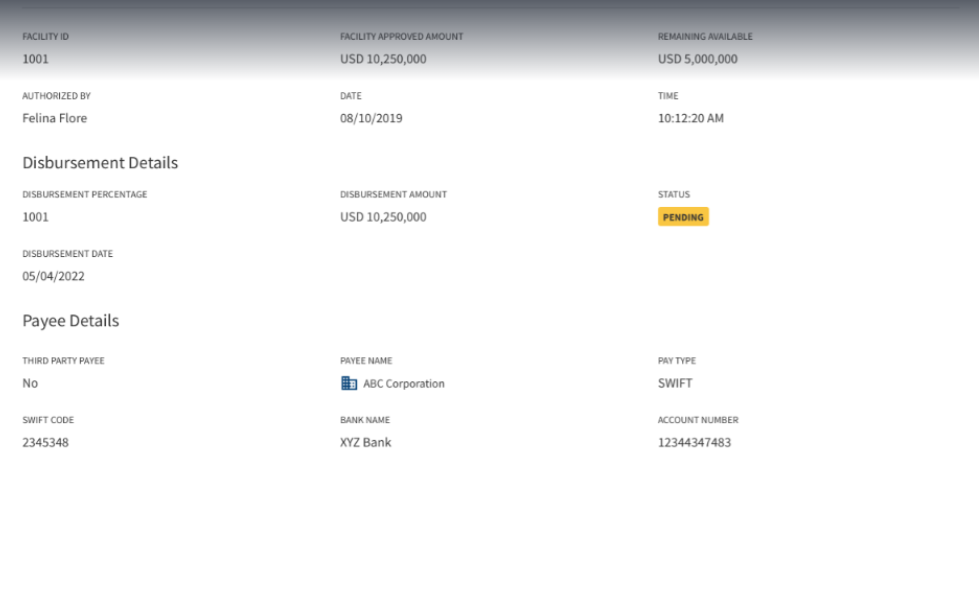

The middle-office user creates the funding in this section. The application displays the actual loan draw-down amount with the following details: Entity name, Disbursement amount, Date, Status, Total Disbursement Amount, Facility Approved Amount. The Funding position is available only after Approval of Amount is given for a Facility.

Perform any of the following actions:

- Click the row to view the details.

- Click Edit to modify the details or click X to close the form.

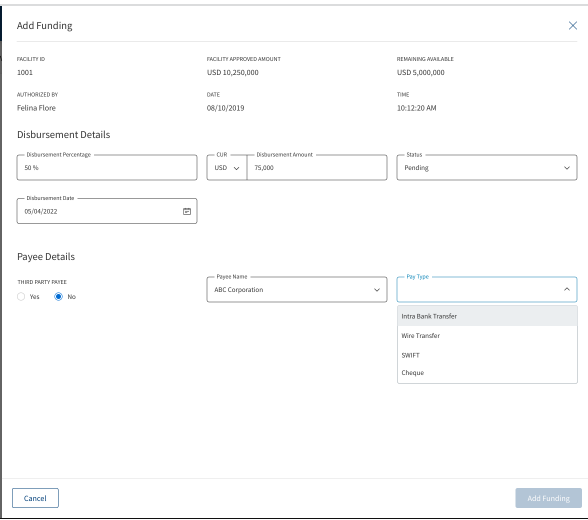

- Click Add Funding to add a new funding for the facility.

- Select any of the following options from the context menu :

- Click Edit to modify the details. Only the records with a Pending status can be edited.

- Click Delete to remove the record. Only the records with Pending status can be deleted. In the confirmation pop-up that appears, click Yes. The record is removed.

- An approved record can only be deleted by a Supervisor.

- You can Add funding only if the Loan amount modification is requested and approved.

- For Modification facility overview Add Funding is enabled only if the Increase Loan amount modification is requested and approved by the underwriter.

The application displays the following fields:

- Facility ID

- Facility Approved Amount

- Remaining Available

- Date

- Time

- Disbursement Details - Disbursement Percentage, Disbursement Amount, Status, Disbursement Date.

- Payee Details - Third Party Payee, Payee Name, Payee Type.

- Add the following details. Unless otherwise stated, all fields are mandatory:

- Enter the Disbursement Percentage.

- Select the currency and enter the Disbursement Amount. This field has predictive search where you can enter your option in the box and select the required option from the matching result rather than scroll down the list to select a currency.

- Select the Status from the list - Approved or pending.

- Enter the Disbursement Date. In this field only the future date can be entered,if the user enters past date, a validation error displays.

- Choose whether the payee is a Third Party Payee. The default option is No.

- Select the Payee Name from the list.

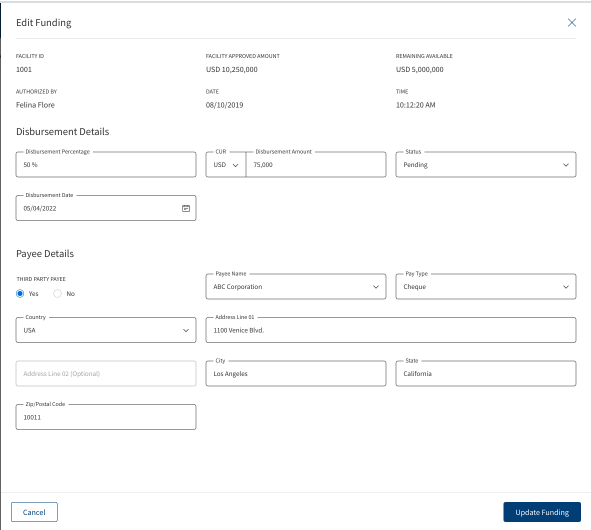

- Select the Pay Type from the list. The Pay Type options are as follows: Intra Bank Transfer, Wire Transfer, SWIFT,Cheque. Every Pay Type displays different corresponding options.

- Enter the Account Number.

- Enter the Route Number.

- Enter the Bank Name

- Select the Address Type. After selecting the address type, all the corresponding details are prepopulated.

- Disbursement Amount is calculated as the difference between the Gross Amount and Hold Back.

- In the disbursement date field,only future date can be entered. If the user enters past date, a validation error displays.

- If the funding is for a third-party, then the user must capture the address details.

- If the funding is for the related parties, then the user must select the party from the list and the address corresponding to that party.

- The Add Funding option is enabled only if the Disbursement Amount is less than or equal to the Approved Amount.

- Click Add Funding. The application displays a confirmation message that the funding record is added successfully.

- For a Modification facility the approved amount is the extra amount that is requested and approved by the underwriter and not the complete loan amount.

Only the records with Pending status can be edited.

- The application displays the Facility ID, Authorized By, Date, and Time.

- Make the changes required based on the requirements.

- The Disbursement details and Payee details can be edited on the Edit funding screen.

- In the disbursement date field,only future date can be entered. If the user enters past date, a validation error displays.

- Click Update Funding to save the details.

- The application displays a confirmation message that the record is updated successfully.

Click Cancel to discard the changes. On the confirmation pop-up that appears, click Yes. The changes are discarded and not saved.

- If the entered or Calculated amount in the amount field is more than the Remaining Available amount, the Add/Update Funding button is disabled in Add/Edit Funding screen.

The View options displays the overview of the Funding page and has an Edit option available only if the status is still in Pending.

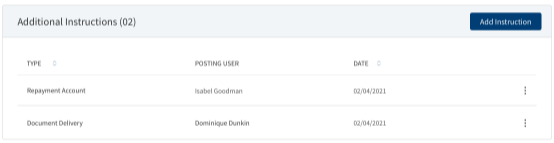

Additional Instructions:

The Posting User adds the necessary additional Instructions whenever applicable. It displays the fields as follows: Type, Posting User, Date.

For Retail - A bank user with the necessary permissions can view and manage (add, view, edit, delete) the feature. Incase a Product has a drawing, the user needs to select the Drawing first then the Additional Instruction is added. If the Product has Drawings the system does not allow to add Additional Information at the Product level. If the product does not have Drawings, the Additional Instruction can be directly added to the Product.The Additional Instruction for a Drawing added from the Product Overview display in the Additional Instruction section in the Drawing Overview and vice versa.The Additional Instruction entry for drawings added in the Product Overview displays in both the Product Overview and the Drawing Overview with Pending status. The Bank user can review Drawing wise Additional Information from the Product Overview and change the status from Pending to Approved.

Display of Additional Information record at Drawing Level in Summary screen:

- The Drawing ID displays in an accordion view.

- Expanding the accordion displays all the Additional Information records in reference to the particular Drawing:

- Type

- Posting User

- Date

Add Instruction:

The application displays the following :

- Facility ID

- Facility Type

- Authorized By

- Date

- Type

- Payee Name

Facility ID, Facility Type, Authorized By and Date are prepopulated in this section.

The Types of Add Instruction are as follows : Fee Collection Details, Repayment Details.

- Select the Type and Payee Name from the drop-down list.

- On Selecting each Instruction Type different corresponding options display.

- Auto-pay Details- Enable or Disable toggle button based on your requirement (applicable only for Term Facility and Mortgage Facility) for other Facilities the default option is No/Disable.

- If the Auto-pay is selected as NO, all the Bank details fields are Optional.

- If the Auto-pay is selected as Yes, all the Bank details fields are Mandatory.

- Enter the Bank Name

- Enter the Route Number.

- Enter the Account Number.

- Click Add Instruction to save the details.

There are 3 Instruction Types available, Only one Instruction type is applicable for one instance, once a particular Instruction type is selected it will no more be available in the dropdown list for the next instance.

Select any of the following options from the context menu :

- Click Edit to modify the details. Only the records with a Pending status can be edited.

- Click Delete to remove the record. Only the records with a Pending status can be deleted. In the confirmation pop-up that appears, click Yes. The record is removed.

Edit Instruction:

Click the Edit option from the Context Menu. This displays the Edit Instruction page where the Party Name and Bank Details can be edited, After the required changes are made click Update Instruction or Cancel to go back to the previous page.

After clicking the row from the list, the overview of the Updated Add Instruction section is displayed in the View Instruction page.

This section provides an overall view of the status of all the items grouped by:

- Due Diligence Summary: This feature is not applicable for Retail lending and SME lending requests and is not visible to the bank user roles who manage these requests.

- Compliance Summary

- Conditions Summary: This feature is not applicable for Retail lending and SME lending requests and is not visible to the bank user roles who manage these requests.

- Document Summary: This section displays documents uploaded by the Bank user /customer from Origination app. It also displays the Document category, Document type, Document Name, Applies To and status. The accordion view shows the list of Documents in the Document category.

- Borrower Fees

A glance at the color code of the items shows the status of each item in the group.

- Gray

denotes the processing of the items have not started yet.

denotes the processing of the items have not started yet. - Blue

denotes few items in the group are to be completed.

denotes few items in the group are to be completed. - Green

denotes all items in the group have been completed.

denotes all items in the group have been completed. - Orange

denotes items in the group are pending.

denotes items in the group are pending. - Red

denotes items in the group have failed.

denotes items in the group have failed.

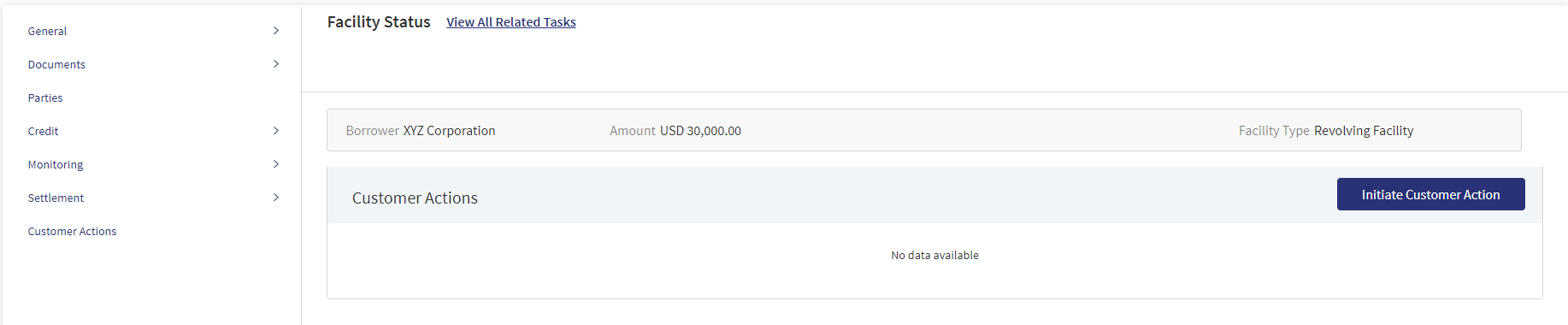

Customer Actions

This is applicable for Retail Journey.

A User can raise Customer Actions (Manual) at the Product level and not at the Drawing level. Automatic or system generated customer actions are generated at the Drawing level. Funding related customer actions are at the Drawing level and not at the Product level (in case the Product has drawings).Funding related customer actions are generated depending on the number of drawings the Product has. Each drawing has a separate customer action.

- Additional Information for repayment related customer actions display at the Drawing level and not at the Product level(in case the Product has drawings).

- Additional Information for repayment related customer actions is generated depending on the number of drawings for the Product.

- If the Product does not have drawings , then the funding related customer action is triggered at the Product Level.

The Applies To displays the Drawing ID, in the Funding customer action for Drawings .

The customer actions display in the Entity Overview/ Request overview/ Product Overview / Drawing Overview.

- The Applies To displays the Drawing ID, in the Additional Information customer actions for Drawings.

Please refer to the link for Permissions.

Please refer to the link for Detailed information regarding Customer Actions.

APIs

For the complete list of APIs shipped as part of this feature, see Experience APIs documentation.

In this topic